24Option To Drop TechFinancials

The New Age Of 24Option

We have learned, through a story first broken by FinanceMagnates, that leading broker 24Option has decided to drop TechFinancials as their technology provider. The company, owned by Richfielf Capital, has decided to use a proprietary and in-house system for future trading and payment processing. While the benefits for 24Option are obvious, those for the traders and TechFinancials are not. The move is expected to take effect 30 April 2017.

TechFinancials is the current technology and payment provider for 24Option, the flagship brand of the company. TechFinancials went public in an IPO late 2015 and has since been the leading provider in the industry. The move by 24Option will not be a good one for the company as it is their number 1 source of income. In their statement TechFinancials said that there will be no material impact on the current quarter but may have an impact on future quarters. In fact, the board has already declared a halt to dividend payments in response to the news and will defer making further decisions until the full effects of the change are felt. The company has been working hard in recent years to diversify across markets so impact may be muted. TechFinancials is traded on the London Stock Exchange under the ticker symbol (TECH).

“The Company had prepared for such an event and has invested in a diversification strategy that commenced in 2016 to mitigate the effects of this. While the Company expects income in the first quarter of 2017 to be in line with management expectations, it is likely that this event will have an adverse impact for the rest of 2017, both on the Group’s income and on EBITDA.”

The exact details of the binary options industry are not know but 24Option is widely thought to be the largest broker in terms of market share. Their move to in-house their technology is not a new one although it is not common in the industry. Other top brokers including AnyOption and IQOption have long run on proprietary technology and it has suited them well. One benefit, as shown by AnyOption, is the ability to adapt more quickly to the needs and wants of traders, another is to develop new and interesting option choices that a white label broker would not be able to do.

Regulation may also have something to do with the decision. Regulators around the world are stepping up their game when it comes to controlling the market and holding brokers accountable. By taking control of their platform and payment processing 24Option removes a risk inherent with third-party services and enables themselves to adapt more quickly to change.

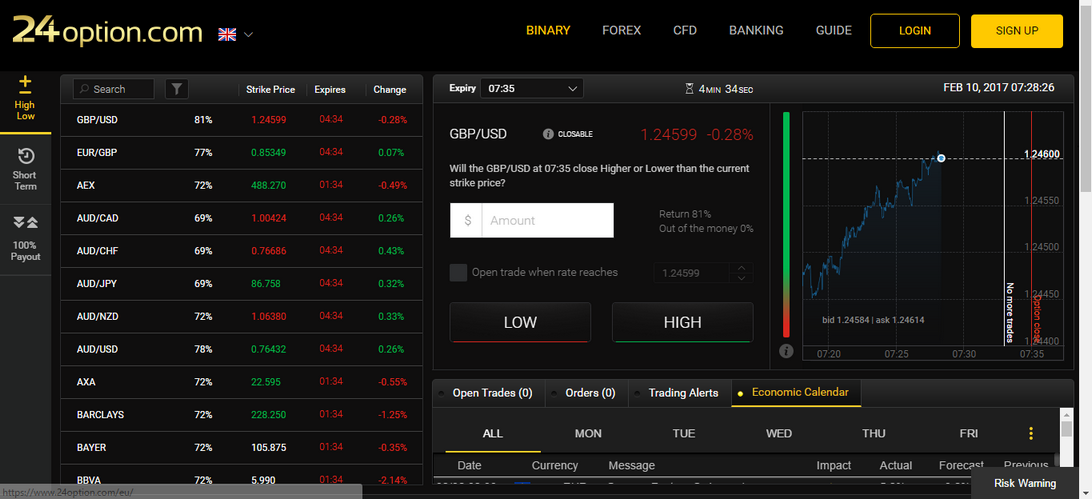

24Option is one of the oldest and most trusted brokers in the binary options industry. Founded in 2009 it has been leading in terms of trading, service and regulation the entire time. One of the first to become CySEC regulated the broker is now registered throughout the EU, operating under the MiFID and Financial Passport. While binary options is the primary product the broker also offers simplified forex, CFD and ladder style binary option trading. What the change means in terms of trading is simple, you get the same great trading as before, with a nicer cleaner look and new features.