4 Things to Know About Trendlines

Misusing trendlines can result in a number of trading problems. Since trendlines are often one of the first technical analysis tools new traders learn about, there are several things you should know before you start relying on them too heavily. While each of these points is addressed individually, they all need to be considered while trading, as they work in conjunction with each other.

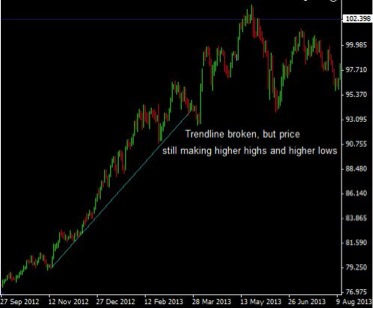

1. Trendlines are a visual aid for seeing trends. An uptrend is composed of higher swing highs and higher swing lows. Therefore, watch price action as well, not just the trendline. The price may break below a trendline, but if the price is still making higher highs and higher lows, the trendline breaking isn’t necessarily a concern.

Figure 1. USDJPY Breaking Trendline, But Still Making Higher Highs and Higher Lows

It’s also possible the price could start making lower highs and lower lows, yet still be above the trendline (during an uptrend); this does warrant caution because price action is indicating a potential reversal.

The same principles apply for downtrends.

The bottom line is that trendlines should always be used in conjunction with price analysis.

2. You need at least two price points to create a trendline which can then be extended off to the right. But you need a third point to actually respect that trendline in order to give it any validity.

For example, an uptrend requires two swing lows in order to draw the trendline by connecting the lows. A third swing low is required to occur in approximately the same area as the trendline. With three points there is a potential pattern.

Figure 2. GBPUSD Daily, Trendline Drawn After Two Swing Lows with Third and Fourth Swings Confirming It’s Valid

3. A trend may have multiple trendlines, and there may be multiple trendlines in effect on different time frames and in different directions. During a long-term (relative to your trading time frame) uptrend or downtrend it is likely that you’ll be able to draw a number of different trendlines, at different angles, because there are multiple swing lows or swing highs that can be connected.

Since shorter-time frames show the smaller price swings not visible on longer-term charts (consider a 15 minute chart versus a daily chart), traders can view trends and trendlines on different time frames to help isolate area for entries or exits.

Anytime there are significant waves in one direction a trendline can be drawn. This will aid in analysis; for example, if the price is rising a in a long-term uptrend and price is making overall higher highs and higher lows, but on the short-term is making small waves lower that are composed of lower highs and lower lows, it’s likely the small downward trendline just represents a pullback in the longer-term uptrend.

4. Trendlines often need to be redrawn. Based on the above points, it is very common to have re-draw trendlines slightly to accommodate new price information. Trendlines are just a rough visual guide; the price will often not quite reach them or move slightly past them (note: this why trendlines are mostly used for analysis, and generally not used at trade signals/triggers). When this occurs you may wish to redraw the line to better suit all the available information. Just because a trendline is penetrated does not mean it is a significant event; consider the other evidence and price analysis before deciding how to proceed.

Final Word

Trendlines are useful, but try to think of them as visual aids, not magic points on the chart. Ultimately how price is acting is the most important thing, and trendlines just provide potential areas where price may find support or resistance. There are often many trendlines in play on different time frames, in different directions. Redraw trendlines to suit the price action. The trendline can go through some bars, or be right at high or low points. Since the trendline is only a guide, and typically not used for triggering trades, it doesn’t need to perfectly fit the price action to show what price is doing overall.