Cantor Exchange Review

Cantor Exchange has been working with a number of top binary options technology providers and is about to change the face of the US market.

Cantor Exchange Working With Leading Technology Providers

US based binary options exchange Cantor Exchange is preparing to change the face of the US binary options market. The exchange, referred to as CX by insiders, is pure exchange style trading environment and one of only two CFTC regulated binary options brokers. Over the past year or more the exchange has been working with a number of top technology providers to expand liquidity, increase traffic and enhance visibility in what many consider to be the next step in the evolution of the business.

Who’s involved? SpotOption, TechFinancials and Tradologic have so far been named with hints that there are others waiting in the wings. Integration with CX is not simple and requires an extensive certification period lasting 6 months or more which is one reason it has taken so long for technology providers to make this move. What they are doing are building platforms through which traders will be able to access the marketplace. Cantor execs are adamant in saying that when you trade on one of these platforms you are indeed trading with other traders on Cantor Exchange and not making a bet with the broker.

As an exchange, a true exchange where every buyer and seller has access to all available price offers, CX primary function is to provide the location where trading takes place and the oversight to ensure that regulations are being maintained. The purpose of these new moves into the US market is to create gateways and portals through which traders can access the exchange. According to Rod Drown, Senior Managing Director at CX, there are no exclusive market makers and no exclusive access to pricing. If an offer exists in the market, and you access the exchange, you will be able to see it.

What This Means For US Binary Options Trading

SpotOption was the first to go live on the exchange. Reports from ForexMagnates say SpotOption was providing liquidity and access as early as February of 2015 while TechFinancials is expected to go live sometime during the second half of the year. Regardless, the benefits are already being seen. The addition of the one platform has increased liquidity to the point that Cantor has been able to add Gold contracts to its growing line up of assets. Once TechFinancials begins operations that list is likely to grow again. It is unclear when the Tradologic platform will be ready but signs indicate it will be quite soon.

The goal for them all is to produce a white label version of their platforms that they can then sell to brokers for rebranding. Each broker will be independently owned and operated and responsible for its own registration with US regulatory bodies. This is not a requirement for access to the exchange unless the broker is planning to solicit clients in the US. There is already talk of several new brands simply waiting for the go-ahead to begin operations. Tradologic has hinted at at two while TechFinancials has gone so far as to release a name, OptionFair.

First Review Of SpotOption At CantorExchange

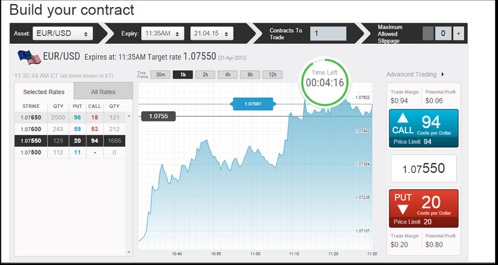

My first look at the SpotOption platform on Cantor Exchange is very promising and enough to make me want to switch brokers. They have managed to maintain the great look and easy to use features that have made SpotOption so popular among CySEC style brokers. You really have to look at it to see the differences but they are there. They have also managed to blow away the platform provided by NADEX which is sure to make them a number one choice among US traders. The platform displays expiry, number of contracts, risk/reward and an easy to read display of available strikes and their market prices.

The asset list and available expiries are still limited but will surely grow as more traders enter the market. Currently the SpotOption platform supports only 5 currency pairs; the five top pairs traded including the USD/JPY, the EUR/USD and the GBP/USD. Expiries are intraday and end of day including 11:45AM, 12AM and 4PM. The feature that really sets this platform apart from both NADEX and CySEC regulated brokers is slippage control. If you look at the top right of the graphic you can see a setting which controls how much draw down you will allow the trade thereby limiting your risk exposure. Two things that are also noteworthy, these options provide the highest possible returns, up to 900% or more on the right trade, and can be bought or sold at any time during their lifespan.