Digital100s

Digital 100’s is a new name for an old and trusted form of binary options trading, if you aren’t using them you are behind the curve.

Digital100s – An Option By Another Name…

There is a new type of option on the market and it is sweeping the financial world. No not really but there is a new name for an old type of trading we here at BinaryOptions.Net like very much, Digital 100’s. If you think this sounds like NADEX or the 0-100 Options once offered by Anyoption you are correct.

So, what exactly are Digital 100s? They are the same CFD type binary options offered by exchanges like IQ Option and CMC Markets but with a new name. The change does nothing to alter the trading but it does bring the name in-line with what other binary options exchanges have offered making them more appealing to former spot-style traders.

How do they work?

In essence the Digital 100’s are a CFD, a contract for difference, with a binary outcome. Where a true CFD has no expiration and can be held open indefinitely, a binary style Digital 100 does have an expiration and a max payout/loss at that time. At expiry the options is worth all or nothing, $0 or $100. During its life however, the value will change based on market pressures, the cost of the underlying asset and the chance the option will close in the money.

For example, if you are looking at a Digital 100 for the EUR/USD and the current price is $50 you pay $50 to own it. If the option closes in the money it pays out $100 which means you get your $50 back plus 100% profit. If the price of the options is $40 when you buy it your return would be $60 or 150%, if the price of the option is $60 when you buy it the return would be $40 or 66%.

Brokers Offering Digital Options, or Digital100s:

Ladder Prices

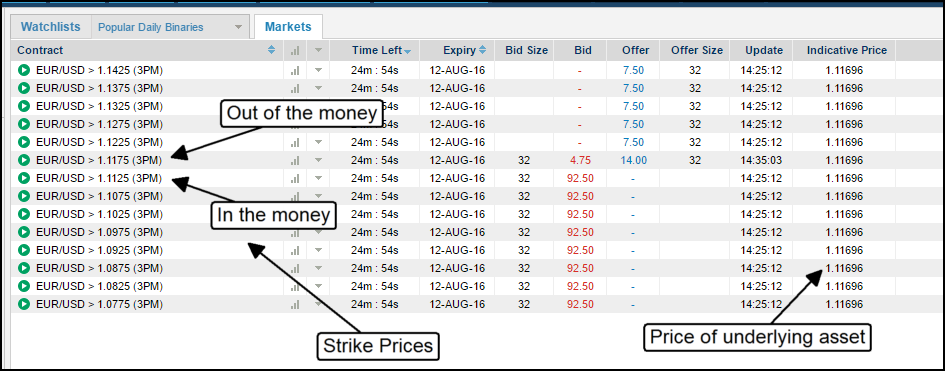

Digital 100’s are offered in several option types but the most common is the Ladder. Ladders are sets of strikes with a common expiry. The strikes are a range of prices that the underlying asset can close above or beneath. Traders choose their strike and buy at the market price. An at-the-money strike usually costs about $50 because there is a 50/50 chance it will close in the money. In-the-money strikes cost more because there is a higher chance of the closing in-the-money, less risk, and out-of-the-money strikes cost less because there is a lower chance of them closing in-the-money, more risk. Other types of Digital 100’s you may find include One Touch, Up/Down and Range.

The best part about this type of binary option is selling them and I don’t mean closing a position. Unlike spot style trading where you have to buy a put when you are bearish Digital 100’s trade like forex and commodities, you sell them to open in the hopes of buying them back at a lower price. This means you get a credit in your account for the amount of sale but are also liable for the full $100 should the option close in-the-money. The good news is that your risk is not $100 but $100 minus the price you received. If you sell an option for $75 you are only liable for the other $25.

Lots

Digital 100’s trade in lots just like other types of CFD’s. Each lot will cost somewhere between $0 and $100, if you want to trade more than that you will have to buy more lots. For instance, if you like to trade $1000 at a time and the price of the option is $65 you will need to buy 15 lots, $1000/$65=15.38 rounded down to 15. Positions show in your account like this, +10, for a bullish or long positions and like this, -10, for a bearish or short position. Expiry range from 2 minutes at NADEX and 5 minutes at IG and CMC out to one week at most of the exchanges. I have not seen any with longer than that yet.

With regulators considering a ban on binary options in Europe, the definition of a “binary” option, and these digital 100s might be crucial to the future of these types of trades. If digital 100s avoid the ban, then they may morph into the the size and scale of product that binary became – hopefully without the dishonest operators.