Knock Outs – What Are Knock Out Options?

Knock Out options are a recent innovation by IG Group. The concept may quickly spread to other brokers, particularly as they are similar to binary options, but avoid the ESMA ban for EU traders. Here we explain what knock outs are, how pricing and premiums work and how traditional option greeks, vega and delta, still apply, with an example.

Overview

Knock Outs are a new product from IG Group and I think I already love them. These positions operate like a binary return derivative but are so flexible I think you will love them too.

Knocks Out are a new kind of spread-bet with a lot to offer. As a spread-bet they are an option, based on the spot price of the underlying asset.

Profit or loss is based on the number of points or pips the assets price moves before you close the position. Unlike traditional spread-bets, Knock Outs have automatic trigger points for profits and losses that make them a little binary in nature.

Unlike binary options Knock Outs have extended expiry length, can be opened or closed at any time, have an option premium to affect the price, and are affected by dividends. As a more traditional option, they are also exposed to the ‘greeks’ of vega and delta etc.

How Do They Work

This is how Knock Outs work:

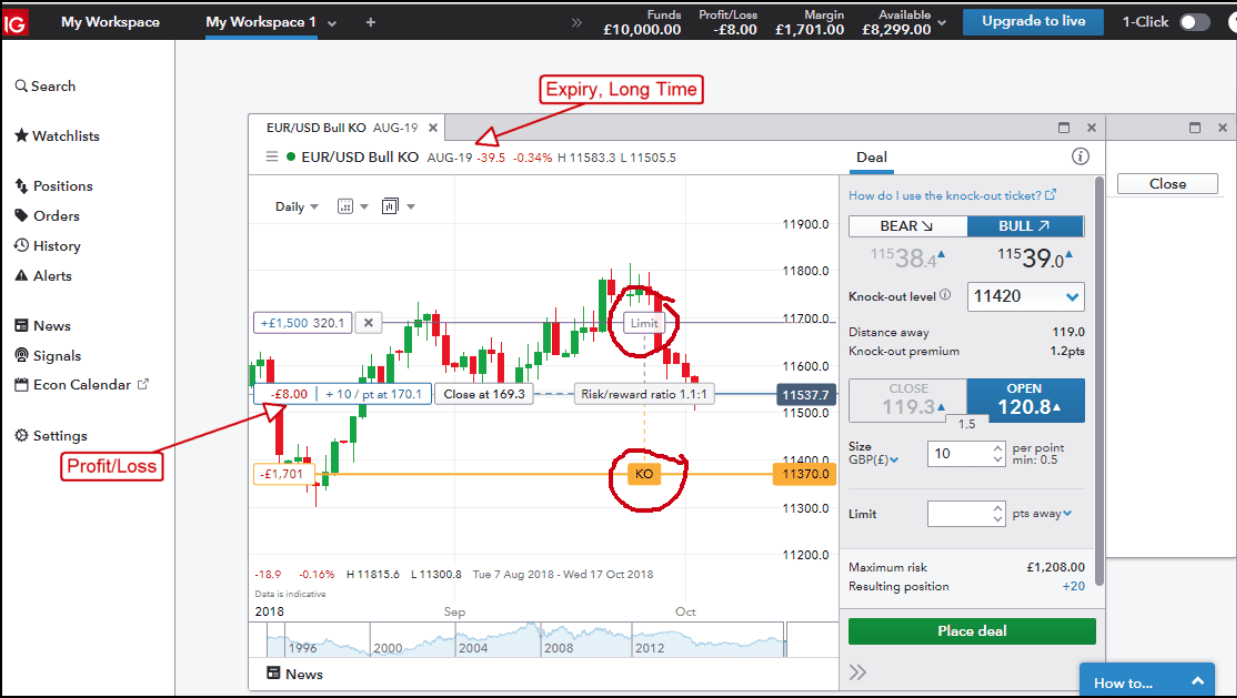

When you open the IG platform for spread-betting you will see options for traditional Spread-bets and Knock Out spread-bets.

Unlike traditional spread-bets which are bought for long bullish positions or sold for short bearish positions Knock Outs are only bought.

You buy a Bull Knock Out if you think the assets price will move up, you buy a Bear Knock Out if you think the assets price will move down.

When you are purchasing your Knock Out you get to pick from a list of possible knock out levels. These levels are your risk, the farther away from the assets price at time of purchase the larger the risk or possible loss.

This level is the price at which your trade will be counted as an automatic loss and is, in effect, a stop-loss order. If, at any time, the assets price reaches your Knock Out level the position closes at $0.

Profit and Loss

The good news is that your position may begin to show profits immediately. Because the Knock Out is a spot position and the spread between the bid/ask for the assets are fairly tight it won’t take much movement for your position to profit or lose.

Because the Knock Out is a regulated spread bet you can close it at any time you choose to lock in profits when you see them. You may also buy and sell the same asset repeatedly in order to capture small price movements over and over again.

Expiry

Knock Outs come with expiry but it is likely you will not wait around for that to happen. In the case of the EUR/USD the expiry is currently about ten months away from the time of writing.

You could, if you thought the EUR/USD was going to move higher over the next year, keep your position open until expiry. If the position is open at expiry it will close automatically and lock in whatever amount of profit or loss is showing at the time.

Option Premium

The option premium is a little confusing at first but not to hard to understand. It is a multiplier attached to each asset based on its volatility and risk.

If an asset is volatile it will have a bigger multiplier, if it is less volatile it will have a smaller multiplier. The multiplier is used to adjust the price you pay at the time of purchase and can have an affect on your option during its lifespan.

If the multiplier gets bigger while the position is open it will increase its value, if the multiplier gets smaller while the position is open it can decrease the value.

Dividends

Knock Outs are also affected by dividends if the asset in question pays them. For example, the US 500 (S&P 500) pays a dividend once per quarter.

When the index goes ex-dividend (when owners are locked into their payments) the price of the index will fall. If you own a Bull Knock Out your account will be credited the dividend amount to make up the difference, if you own a Bear Knock Out your account will be debited to make up the difference.

I’m sure by now you are at least interested in the Knock Out options, I know I am. I think they are very flexible, easy to trade, allow plenty of room to profit and have a virtually open-ended expiry; what’s not to love. If you are trading CFDs or spread-bets and looking for something better Knock Outs could be your answer.