Binary Options Pricing

Binary options pricing models are relatively straightforward. Brokers normally offer all-or-nothing style binaries with fixed payouts. Alternatively, some binary options trading platforms, primarily in the US, follow a $0 to $100 payout structure.

This guide explains how binary options pricing works, along with the merits and drawbacks of each approach. We also explain how binary options brokers make money, unpacking typical trading fees and account charges.

Fixed Payouts

In the fixed payout model, traders are offered a pre-determined return by the broker.

Suppose you bet $100 that the value of an underlying asset will rise in 60 seconds and your broker offers a 75% payout. That means you will:

- Earn $75 if your prediction is correct

- Lose $100 if it turns out to be incorrect

The fixed payouts offered by binary options brokers typically range from 60% to 95%, with popular forex and stock assets offering high payouts while volatile crypto assets normally have lower payoffs.

With this binary options pricing model, brokers make money through the difference between what they pay out in winning trades vs the amount they collect in losing trades.

The fact that payouts do not usually exceed 100% also plays in the broker’s favour. This is because traders usually need to win more than half of trades to make a profit in the long run.

Suppose that, on the same asset, stake and expiry, broker A offers a fixed payout of 75%, while broker B offers 85%. This means that, if you choose to work with broker A, you need to win 58 trades out of 100 to make a profit, while, with broker B, you need to win 55 trades.

Leading brokers that follow this digital options pricing formula include Quotex and Pocket Option.

$0 To $100

Some brokers, including US-based Nadex, use a different binary options pricing system whereby the price of the contract can have only two possible values at expiration, either $0 or $100. There is also a bid and ask price like in other financial instruments.

Suppose the price of silver is currently trading at $25 per ounce. A broker asks whether the price of silver will be above $27 at 16:00 today and offers a bid price of $45 and an ask price of $48, excluding fees.

If you believe that the price will be above $27 at 16:00, you could buy the contract at $48.

Potential outcomes at expiry:

- The price of silver is above $27 – the contract finishes in the money at $100 and you make a profit of $52 ($100 – $48)

- The price of silver is below $27 – the contract finishes out of the money at $0 and you make a loss of $48 (purchase price)

Bid and ask prices fluctuate based on how likely traders believe it is that a proposition will be correct. If the bid and ask are around 50, then traders aren’t sure whether the contract will finish in the money ($100) or out of the money ($0). If the bid and ask prices are 80+, then those on the buy-side believe there is a strong chance the binary option will finish at $100.

Overall, traders may prefer this binary options pricing model because it can yield higher profits. Another advantage of this model is that it is easier to implement a hedging strategy.

How Binary Options Brokers Make Money

A binary options broker usually makes money through the trading volume on its platform. The profit of a broker will normally be determined by the difference between the amount paid out in winning trades and the amount received on losing trades.

Suppose a broker has 1,000 clients that trade a binary option with a payout of 75% and an expiry time of 30 seconds.

Assume each trader places a $100 investment and half of them chooses a call option, while the other half chooses a put option. This means that, after 30 seconds, 500 of them will be in the money and 500 will be out of the money.

The net profit of the broker will be $12,500; that is the amount it will get from the losers (500 x $100) minus the amount the platform will pay to the winners (500 x $75).

Hence, brokers are less interested in the wins or losses of a single trader, but instead concentrate on the payouts and outcomes of options contracts as a whole to generate long-term profits.

In the fixed payoff and $0 to $100 binary options pricing models, the payouts offered and the bid/ask prices play a key role in the profits and losses of different trading platforms. However, binary options brokers can also generate revenue through other means.

Some binary options brokers charge a commission based on your trading volume, while other platforms charge fees based on the actions you perform on your account, such as withdrawal or dormancy. Additional costs can come in the form of currency conversions, plus fees for trading signals and early contract exits.

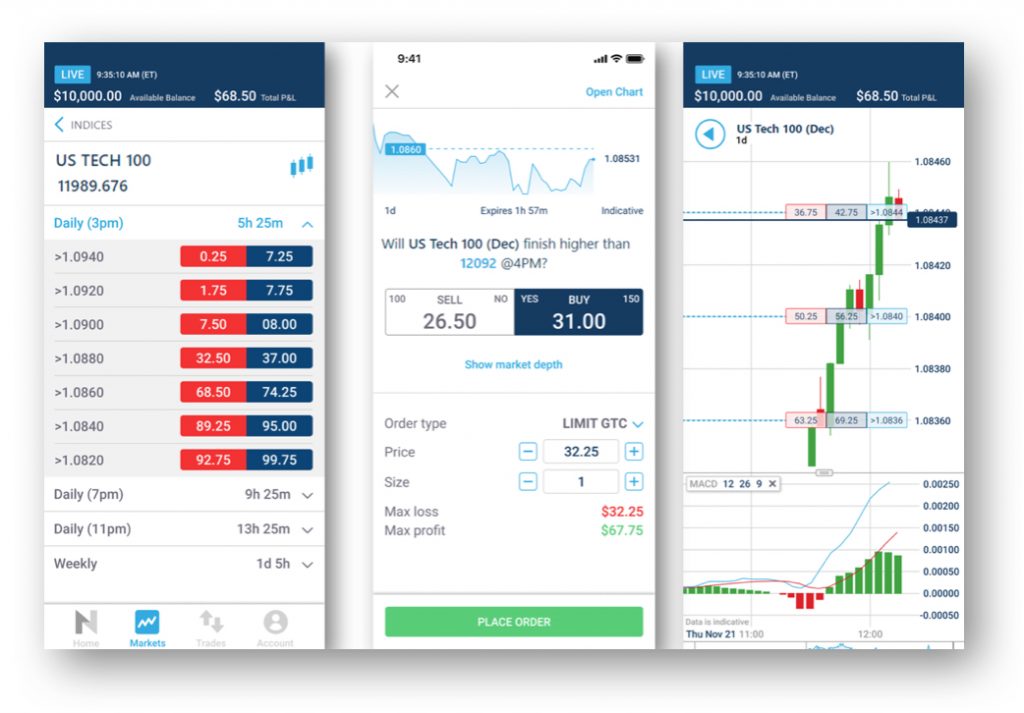

NadexGo Offering 0-100 Options Pricing

Final Thoughts

To increase your chances of making money in the long term, it is worth understanding how different binary options pricing systems work.

Straightforward, fixed payouts are offered by most binary options brokers today. These binaries are easy to understand, offering an all-or-nothing proposition.

The $0 to $100 binary options pricing model is primarily used in the US by exchanges like Nadex. This approach more closely aligns with other retail trading instruments, such as CFDs, which have bid and ask prices.

For beginners looking to understand how binary options pricing works in practice, a demo account is a good place to start. Paper trading profiles allow budding investors to place simulated trades with a virtual bankroll.

FAQ

How Does Binary Options Trading Make Money?

Binary options traders can make money by correctly predicting a proposition put forward by an online broker. For example, will the price of X stock be worth more or less than $Y in 1 hour?

A correct prediction will see the trader take home a pre-agreed payout, usually displayed as a percentage of the amount staked. For instance, 80% on a $100 bet would return the trader $80 (100 X 0.8).

An incorrect prediction will see the trader lose their original investment. In this case $100.

Can Binary Options Be Profitable?

Binary options can be profitable in the long run but traders usually need to win more than half of their trades.

This is because brokers typically offer payouts below 100%. Let’s say a broker offers payouts of 75%. This means you would need to win 58 trades out of 100 to make a profit.

Note, the volatility and liquidity of an asset, alongside other market conditions, will often dictate the payout offered. Assets like cryptos tend to offer lower payouts vs major forex pairs, for example.

How Does Binary Options Pricing Work?

The most popular binary options pricing model is the all-or-nothing approach. This is where traders receive a set, pre-agreed payout for correctly predicting the price direction of an underlying asset. For an incorrect prediction, traders will lose their initial stake.

How Do Binary Options Brokers Make Money?

Binary options brokers make money through the difference in what they pay out on winning trades vs the amount they collect in losing trades. Trading platforms can also generate revenue through deposit and withdrawal charges, account fees and subscriptions to additional tools and market data.