A Good Way to Trade the News

June 25, 2014

One thing I don’t talk much about in my blog is news trading. This is big for some intraday traders who like to pick up profit just by riding a news release. I have done some trading with the non-farm payrolls in the past, but more or less I simply stay out of the market when there is important news to be released. I trade on technical cues, and technical patterns can become irrelevant when market-altering news is released. So always consult an economic calendar during your trading day and identify events – and their associated times – that could affect the pairs you are trading. And if you exclusively trade on technical analysis alone, then I’d always recommend to stay out of the market because news events will simply turn a quality trade into coin-flip odds.

However, the purpose of this article, of course, is to discuss a potential way of trading news for those of you out there who trade based on what you see on the charts, which is a clear majority.

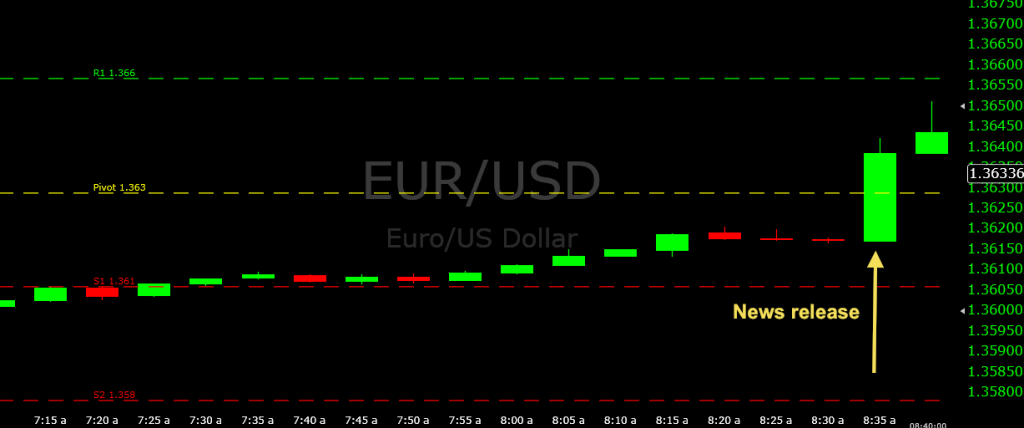

On this particular Wednesday, at 8:30AM EST, news was to be released relevant to the U.S. economy. Durable goods orders were released in addition to U.S. GDP data. Durable goods orders for the month of May came out worse than expected and U.S. real GDP (GDP subtracting out inflation) actual decreased in the first quarter of 2014. Obviously, these events are both bad news for the U.S. economy and such effects will manifest in the nation’s currency, the U.S. dollar. So let’s look at the effects on the EUR/USD chart.

Clearly, you can see that there was a big jump up at news time, denoting that the Euro made gains against the U.S. dollar. The USD is in the “denominator” of the EUR/USD pair, so given the USD lost value, the fraction would become larger, producing a positive jump on the chart.

Also, I should note that the EUR/USD market wasn’t as dull and uneventful as it initially appears on the chart. It’s just that when you get a big jumper candle when important news is released, the charts parameters change and the new scaling causes every candle before the news release to appear small by comparison.

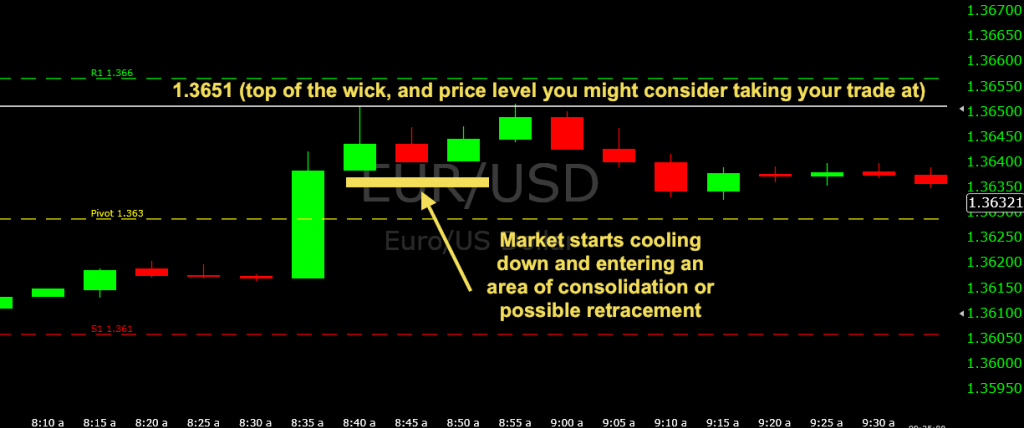

The market freaks out the most when news is initially released and the climb up or down (depending on what the basic details of the news entailed) will usually last 10-15 minutes. After that, you usually have some sort of pullback, as the market regains its losses back against the direction of the news release. That is, soon thereafter, you might actually have the opportunity to trade against the initial direction of the market after the news release.

Let’s look at the actual trade I took:

As soon as the market began its pullback roughly ten minutes after the announcement (i.e., two bullish five-minute candlesticks), a red bearish candle formed to begin the retracement. At this point, I marked off a resistance level at around 1.3651, the pinnacle of the market after the news release. Usually, when I mark off support and resistance levels created from previous price history, I usually go by the bodies of the candles instead of the wick itself. But here, I wanted to mark off the top-most price the market reached (the “high of day” thus far in the market). Moreover, after news time, using the candle bodies for S/R drawings aren’t as good given how volatile the market was. They aren’t as reliable so I prefer the top of the wick instead. And it gives any potential trade set-up a better price for entry.

You’ll also notice that the resistance 1 level (from the daily pivot points family) was about five pips above the resistance level I drew in. Why didn’t I wait for the market to get up to there instead? Because, in all likelihood, the market wouldn’t have gotten that high. I wasn’t looking to take a pivot point trade in this case anyway. I was looking to take it at the daily market high instead.

When the market did get back up to 1.3651 (the daily high at that point), I got into a put option, expecting the market to continue its pullback given the market had been stressed into overpricing itself from the news release. The congestion since the market cooled off also suggested this. And it turned into a great trade. I won by nearly seventeen pips. Not bad considering a good winner with these short-term binary trades is usually 2-3 pips.

There are many ways to trade the news. You can hop in on the initial jump (if your trade can get filled) if you like trading that way (I don’t). Or you can do it this way, by looking to capitalize on the fact that many markets get shocked out of equilibrium after a big news release and often retrace back in the opposite direction to maintain some semblance of their initial balance. I’d never recommend taking a counter trade as soon as the market seems to settle down. Instead, try to use a technical cue to get in like you would in a normal trade like the one I demonstrated in this article.

This is something you might use sparingly, but it’s another way to potentially get into a quality trade.