Best Assets and Best Times of the Day to Trade

I’ve broached this topic in the past during the course of my other posts, but only briefly and felt it would be wise to dedicate an entire space to it.

As always, I recommend that any individual trade at a time convenient for them and also one in which their mental energies are high, as to not lose concentration and focus. It is no good to wake yourself up at 4AM if you’re only going to be groggy, sleep-deprived, and not aptly and effectively tuned in to what you’re doing. It might also cause you to force trades since you technically coerced yourself to get up in order to trade. In the past, I adjusted my sleep schedule in a way such that I’d fall asleep in the evening and wake up at around midnight (even before), so I could take advantage of the beginning of the European market hours as a U.S.-based trader. I maintained this during Friday and Saturday nights when the markets weren’t open in order to not disrupt my schedule.

If you have the flexibility in your schedule to alter your sleeping patterns in order to trade during a desired time window, this is great. But I realize that many, due to work/school/family/outside engagement demands, don’t have the ability to afford these types of accommodations just for trading. After all, if you wish to maintain positive relationships and maintain continued success with regard to school/work outcomes, then it’s really infeasible to be overly “selfish” in adhering to a set schedule that could interfere with those things.

In fact, I’ve heard of some traders lament the fact that personal relationships and even marriages dissolved simply because they had to trade at certain market hours to take advantage of the peak action of an asset they traded or because they had to check the markets so frequently. I think it’s a topic that simply isn’t addressed enough as it pertains to trading and something that might strike a chord with those with more “hardcore” mentalities.

I know there are those who have the mentality that you need to forgo personal relationships in order to be successful at their endeavor(s) – whether it’s trading, an athletic pursuit, school, their careers. Some genuinly don’t feel the need to have close friendships and relationships and that’s okay. But there is always a way to integrate the two together and rarely a need to dive head-first into something at the expense of everything else in life.

(The potential consequences of being overly gung-ho in your trading efforts.)

And sometimes, naturally, you may simply not have the time altogether for trading. For the span of several months, I often do not trade at all because I am a full-time university student and simply cannot prioritize trading or posting here to my blog.

But if you do have the time to trade and can commit to it for a small period each day or most/some days, simply trading at hours most amenable to your schedule is best. Now depending on where this time window falls, it can determine which asset(s) you decide to trade.

For instance, if you are trading the European market hours or the U.S. session, or when these two markets overlap, you can never go wrong trading assets with European currencies or those that also include either the USD (U.S. dollar) or CAD (Canadian dollar). However, if you trade after the U.S. market hours (saw 7PM-12AM EST or so), you might actually be best off trading a currency pair containing one or both of the JPY (Japanese yen) or AUD (Australian dollar), as these currencies will be more actively trading during the openings of the Japanese and Australian trading hours.

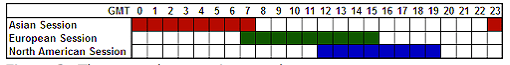

In terms of market hours, here are rough approximate estimates of when the three main continental market sessions open and close and the corresponding uptick you can expect in volatility of various currencies during these times:

Asian session: 11PM-8AM GMT

European session: 7AM-4PM GMT

North American session: 12PM-8PM GMT

Here is a visual of the overlap:

Here are personally some of my favorite currency pairs to trade:

EUR/USD – Easily the world’s most traded pair given that it includes the world’s two most popular currencies. The U.S. dollar is first while the Euro, despite its inception as recently as 1999, is second. Because of all the liquidity in this market, its price moves are pretty consistent overall and it’s not overly volatile. Great during both European and U.S. market hours.

USD/CHF – I traded this all the time back at Trade Rush. The price moves aren’t as strong as that of the EUR/USD, given that the Swiss Franc simply isn’t as popular as the Euro. But given that the USD is part of the pair, it acts to stabilize it and drive its volatility. Naturally, U.S. economic news largely determines where this currency trades. Also great during European and U.S. market hours.

GBP/USD – Pair tends to trade pretty well in accordance with the EUR/USD. They both trend pretty heavily in the same direction and have a very high correlation as a whole. If the EUR/USD isn’t trading as well as you might expect or the trade set-ups simply don’t seem to be there, going over to the GBP/USD could be a good decision.

GBP/JPY and EUR/JPY – These pairs definitely have a good deal of volatility. Yet I do find that the GBP/JPY and EUR/JPY do offer a lot of good trade set-ups and obey their support and resistance levels pretty well. Good for European trading and also viable during the Asian session as well when the Japanese Yen trade hands at a decent clip by virtue of that market session being active.

USD/JPY – Doesn’t move as much as many other USD-based pairs, but definitely a viable option for those trading the Asian session (perhaps U.S. traders who might choose to trade during the evening), like the above pairs.

USD/CAD – Given these are both North American currencies, the strongest and most robust price moves will occur during the hours of the North American session.

And indeed, payout can be a big determinant of what assets to trade, but ensuring that these have sufficiently volume in their markets when you do trade is a very important factor to consider overall.