Binary Trading McDonalds (MCD), Capping off a 5/6 ITM Day

August 28, 2014

I had a lot of time on my hands Thursday, as I basically had the entire day to myself free from interruption. So not only did I trade the GBP/JPY during the European session, but I also decided to switch gears and look at some stock trading. First I looked at Apple (AAPL), which didn’t look particularly inviting out of the gate, then over to Coca-Cola (KO), which was about the same. So I looked on over at MCD, which did have some action occurring along a resistance level.

Binary trading for stocks goes into effect five minutes after the market open at Boss Capital, where I trade, which is pretty typical for the brokers who carry equities in their line of tradeable assets.

There was a lot of back-and-forth motion on MCD at the market open. You never really want to take trades when conditions are so volatile for obvious reasons. You should have a smooth market in front of you. Markets going haywire don’t have the viability to support set-ups that come from the basis of technical analysis – that is, where you’re examining price action, support and resistance, trend, charts patterns, and all that to determine when and where to take trades.

Trade #1

But once price settled along support 1 (93.933) on the 10AM (EST) candle, the dust appeared to have settled from the opening rush and price was consistently holding under the level. On the next move up to 93.933 (support 1), which occurred on the 10:10 candle, I got into a put option on the touch of the level. This was virtually in-the-money the entire time and won by about 0.08.

And also notice from the above image how unique the price action on stocks can be. You can get a lot of erratic movement at the open, followed by a settling down period, then basically an extremely steady climb over the next 1-1.5 hours heading into the lunch break.

Based on the nature of stock markets, that’s often what you get. They’re open 6-7 hours a day, have a chaotic opening on frequent occasion, then trend or have some sort of smoother movement for the next couple hours heading into the lunch period, followed by an hour-long dead period when volume tapers off, followed by another three hours of usually choppier price action to cap off the day.

Trade #2

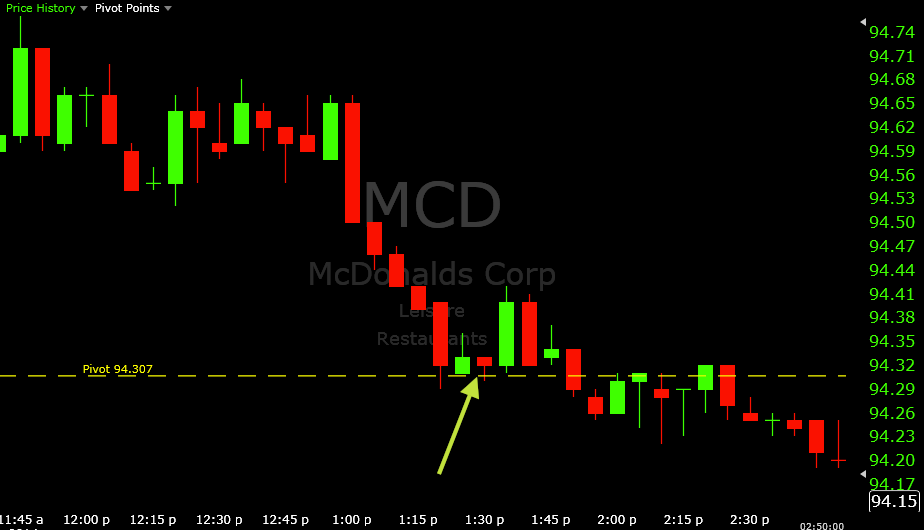

After the morning uptrend that pushed price above pivot, MCD traded between 94.55-94.70 during the 12PM-1PM dead period (i.e., people eating), before going into a downtrend once volume picked back up at the beginning of the 1PM hour. People usually plan their lunch break during the 12PM hour because they know volume will drop off and finding quality set-ups won’t be as doable as it might be during other hours. Hence, a kind of herd mentality produces this low-volume meandering.

Price eventually steadied at the pivot level of 94.307. The bullish/up/green 1:25PM candle seemed to favor that pivot would likely hold as a support level, so I decided to get into a touch of 94.307 on the 1:30 candle. The 1:35 candle provided a nice boost, but those gains were nearly all returned on the 1:40 candle, coming back close to my entry point. Eventually this trade won by about 0.03.

Trade #3

It seems like in all of my recent trading sessions, I’ve had three trades. Seems to be the most likely statistical outcome based on how I trade.

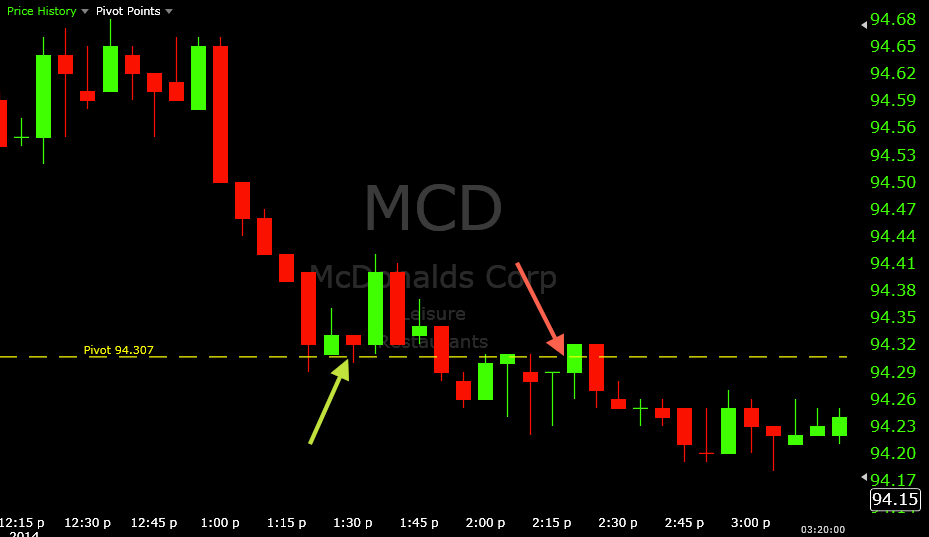

Price fell through pivot on the 1:50 candle. From this point on, when price began settling under the level, it followed the old adage that “old support becomes new resistance” and I began looking at 94.307 for put options. Based on the 2:00/2:05/2:10 candle cluster, the market was definitely respecting this level, so I decided to get in on the next touch. The 2:15 candle also provided a decent amount of evidence supporting a downward move by forming a doji with a about a 0.06 range of lower wick. I was able to get the re-touch on the 2:20 candle. This worked out nicely for a winning margin of 0.06.

So overall, after a rather long day monitoring the markets off and on, I had a rather successful trading day with 5/6 ITM overall.