Channel trading, trend trading, and the importance of never trading based on one factor

I wasn’t able to trade the final two days of last week (which probably wasn’t a bad thing because the market didn’t look very amenable to solid trade set-ups anyway). But I did want to share a couple things I saw just from looking at the five-minute chart of the USD/CHF, the asset I typically trade.

One regarded “channel trading.” I do enjoy trading channels because they are one of the few instances these days where I’ll take trades in higher volumes. When the market is forming a channel, price is consolidated within a relatively tight range – usually around ten pips or so when these appear on the five-minute chart. The basic concept is that if the support level at the bottom of the channel and the resistance level at the top of the channel hold up well, then taking call options at support and put options at resistance can lead to some good trade set-ups.

However, each trading scenario is different and sometimes you may want to limit your trade options based on other things affecting the market. Consider the example below:

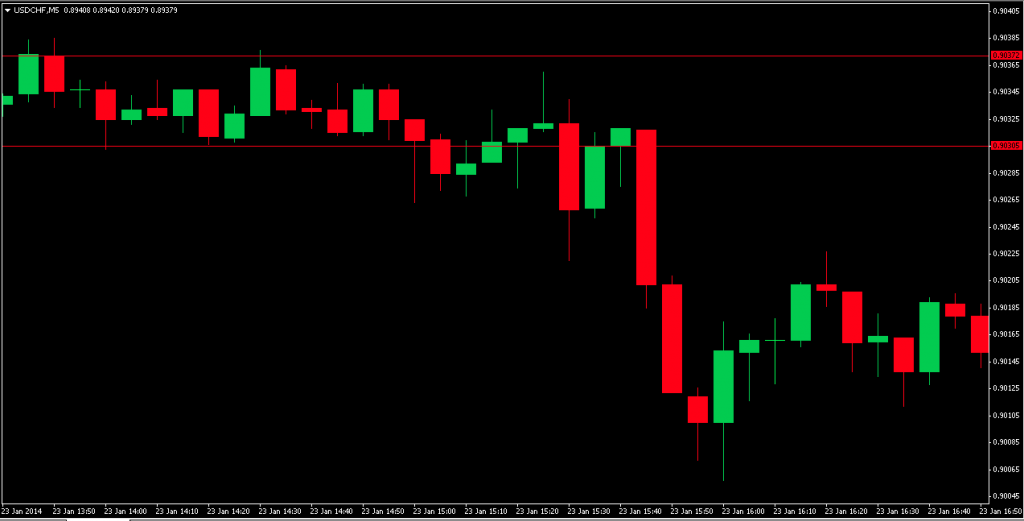

A channel of about seven pips formed on the USD/CHF (Thursday, January 23, 2014), but taking note of the context in which it was formed is very important. If I take a screenshot zoomed way out, you get this image:

Obviously, the market is in a clear downtrend at this point and when a market is trending this strongly in one direction, you would be most sensical to avoid trading against it altogether. Therefore, when trading this channel, I would very much recommend limiting yourself to put options only. This goes for all other trade scenarios in this particular market whether it’s channel trading or not. Trying to trade against a severe downtrend is commonly termed “trying to catch a falling knife” for a reason – because it’s very risky to try and flout the trend by taking call options.

Based on the zoomed up image I have below, I believe taking a put option on the 7:30AM (EST) candle would have been a quality set-up based on the resistance level combined with the downtrend. However, I would have avoided any of the potential call option set-ups that occurred based on the touch of support on the bottom of the channel. Indeed, a couple of them could have won, and you can argue that even if you win the first two and lose the third you’re still making money. But ignoring the trend is never a good idea in trading. The most reliable form of trading in the history of the existence of financial markets has been trend-trading and for good reason.

I realize that I probably don’t talk enough about the importance of trying to follow the trend in my other strategy posts. But rest assured, it is very much something that I do take into account when it’s applicable. Going against strong trends will regularly lead to lower probability set-ups. Almost inevitably in the case of this market, the support level that formed the bottom of this channel was broken and newer lows were formed.

Another thing that I would like to cover is the importance of never trading based on one factor. If it’s a clear downtrend in the case of the previous example, I would never recommend random entries with the trend. You just don’t know with any certainty within a small time period whether this trend is going to continue. In fact, trend reversals happen all the time, especially as news comes out or other markets in different parts of the world open up. Always be careful of the market around 8:30AM EST, as important economic data is often released at this time and U.S. trading begins to heat up.

Also, never trade a price level by itself. In my own trades, you’ll see that even with a robust support or resistance level, I’m never looking to hop on the trade as soon as it touches the level. I first wait for it to reject that level to ensure that it’s still valid. I then will usually take the trade on the re-touch of that level. The older a support or resistance level is, the more important getting re-confirmation can be. If you’re trading the European session and trying to base one of your trades solely on the basis of a support level that was formed many hours ago in the Asian session, you actually might not be dealing with as much of a high-probability trade as you might think.

Take the example below:

Based on this screenshot, if you trade primarily by support and resistance levels in the market it might be very difficult not to take a put option at the touch of this pivot point. After all, if you’ve been trading since the price data formed on the very left-hand side of the window, you’ve been waiting several hours just to take a trade. And in fear of missing out on the trade altogether, you might jump the gun and pull the trigger as soon as price hits that particular pivot point.

But as you can see, this would have been a very bad idea, especially with the increasing volume/momentum heading into the market. A put option at the pivot point above the first would have been a terrible trade to take, as well. Always look for at least two factors to support your trade. Trend and support/resistance levels are important, using pivot points and large-scale Fibonacci retracement levels can also be worthy factors to consider. A big thing for me, though, is “price confirmation,” or making sure that a level is robust enough to consider taking a trade there, which is what I always use in the form of the “touch-reject-retouch” strategy that is a constant theme in all my blog articles.