Deriv

- Min Deposit: $5

- Payout: 100%

- Demo Account: Yes

- Regulated: MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA

Best Trading App 2025 - DayTrading.com

Most Trusted Broker 2024 - Ultimate Fintech Global Awards

Best Trading Experience LATAM 2024 - Ultimate Fintech Global Awards

Best LATAM Region Broker 2024 - Ultimate Fintech Global Awards

Best Customer Service 2024 - Global Forex Awards

Traders from United States NOT accepted

Traders from United States NOT accepted

Deriv offers binary options, multipliers and CFDs on proprietary trading platforms and the popular MT5 app. With 24/7 trading, 100+ instruments and a low minimum deposit, the broker has proven popular with aspiring traders. But should you sign up with Deriv.com?

In this 2025 review of Deriv, our experts unpack the pros and cons of registering for a live account, from trading apps and tools to trust ratings, fees, and regulatory oversight. Read on for our verdict on Deriv.com.

After two decades of operating as Binary.com, the broker underwent a rebrand in 2020 and now trades under the name Deriv. Clients of the original brand can migrate to the new broker using their existing login credentials.

Key Takeaways

- Deriv offers payouts up to 100% and a variety of options products to suit different trading styles and strategies

- 30+ fee-free payment methods are available, including e-wallets and cryptocurrencies

- The $5 minimum deposit and $1 minimum trade value mean the broker is a good fit for beginners

Company Details

Deriv is an established online broker, with 2.5M+ traders globally. The company has a total trade turnover of $10B+ and processes 100M+ trades and $25M+ in withdrawals each month.

The broker has an office presence in 15 countries including Dubai, Singapore, and Cyprus. The company is regulated by several financial agencies:

- Labuan Financial Services Authority (LFSA)

- Malta Financial Services Authority (MFSA)

- Vanuatu Financial Services Commission (VFSC)

- British Virgin Islands Financial Services Commission (BVI)

Options Trading

Deriv offers binary options trading on 100+ underlying assets. Competitive payouts up to 100% are available and the minimum contract size is $1.

Available assets:

- Commodities – Speculate on the price of precious metals and energies, including Gold, Silver, and Oil

- Indices – Take positions on the largest US, European and Asian indices, including the S&P500, FTSE100, and GER40

- Forex – Trade digital options on 28 major, and minor currency pairs, including EUR/USD, USD/CAD, and AUD/NZD

- Basket Indices – Trade commodities or forex against a collection of major currencies. This includes the Gold basket comprising the value of the precious metal vs five global currencies (USD, EUR, GBP, JPY, and AUD)

- Derived Synthetics – Simulating real-market movements, these proprietary indices are not impacted by market liquidity or global events. Instruments include continuous indices such as the Volatility 75 (VIX), jump indices, and daily rest indices

Contracts & Products

Deriv offers a wider breadth of options products than most competitors, suiting various trading styles:

- Digital Options – Predict the result from two possible outcomes. A fixed payout, shown as a percentage, is offered in return for a correct prediction

- Lookback – Receive a financial return contingent on the optimum high or low market price achieved throughout the duration of a contract

- Call/Put Spreads – Gain up to a pre-defined payout based on the instrument’s exit position relative to the two price levels

Digital Options

The broker offers multiple digital options products:

- Rise Or Fall – Will the exit price be higher or lower than the entry price at the end of the contract?

- Higher Or Lower – Will the exit price be higher or lower than the barrier price at the end of the contract?

- Ends Between Or Outside – Will the exit price be within two price markers at the end of the contract?

- Stays Between Or Outside – Will the exit price settle inside or outside two price markers at the end of the contract?

- Touch Or No Touch – Will the price of the underlying asset touch a pre-defined target price at any point during the contract?

- Asians – Will the exit price be higher or lower than the previous average exit prices at the end of the contract?

Lookbacks

Lookback options are available on Deriv’s synthetic indices:

- Close Low – A win or loss equal to the multiplier x the difference between the low and the close price during the contract

- High Low – A win or loss equal to the multiplier x the difference between the highest and lowest price during the contract

- High Close – A win or loss equal to the multiplier x the difference between the high and the close price during the contract

Other Products

CFDs

Deriv.com also offers CFDs with up to 1:1000 leverage. Tight spreads from 0.5 pips on major forex pairs are available with commission-free trading.

As well as forex and the broker’s synthetic assets, cryptocurrencies can also be speculated on using Deriv’s CFDs.

Note, swap rates apply to positions kept open overnight.

Multipliers

The broker offers standard leverage on CFD trades only. However, Deriv has a unique ‘Multipliers’ tool which can be applied to options trades. This feature combines the upside of trading with leverage, alongside the capped risk of trading options with predefined payouts.

- If the market moves in your favor, profits are amplified, for example, by 10x

- If the market moves against you, losses are limited to the initial stake only. An automatic stop-out kicks in when a loss reaches the starting investment

Retail investors essentially benefit from increased market exposure whilst the risk is limited to the initial stake.

Deriv Platforms

Deriv offers multiple trading platforms, notably more than most binary brokers. But on the downside, users cannot trade all binary options contracts on a mobile app. The broker’s MT5 and Deriv Go apps are designed for trading CFDs and multipliers. This is a key drawback vs competitors such as IQCent and Pocket Option.

DTrader

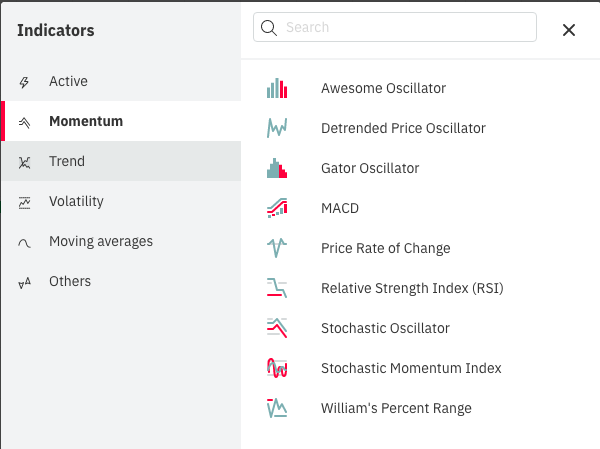

The DTrader platform offers 50+ instruments. While using Deriv’s terminal, we liked the simplicity of the user interface with customizable features available from clear menus on either side.

Other features include:

- 13 timeframe views

- Trade duration from 15 seconds to 365 days

- Four chart types including area and candlestick

- Nine drawing tools such as Fibonacci Fan and Trend

- 20+ technical indicators and widgets including MACD, RSI, and Bollinger Bands

How To Buy An Options Contract On DTrader

- Select an underlying asset to trade (indices, commodities, forex, derived synthetics, or baskets)

- Choose a binary options product (for example, high/low or touch/no touch)

- Decide the trade duration/contract length (15 seconds to 365 days)

- Input the trade stake ($1 minimum)

- Payout percentages are displayed automatically. Alternatively, input a desired payout to receive a suggested stake value

- Confirm the order

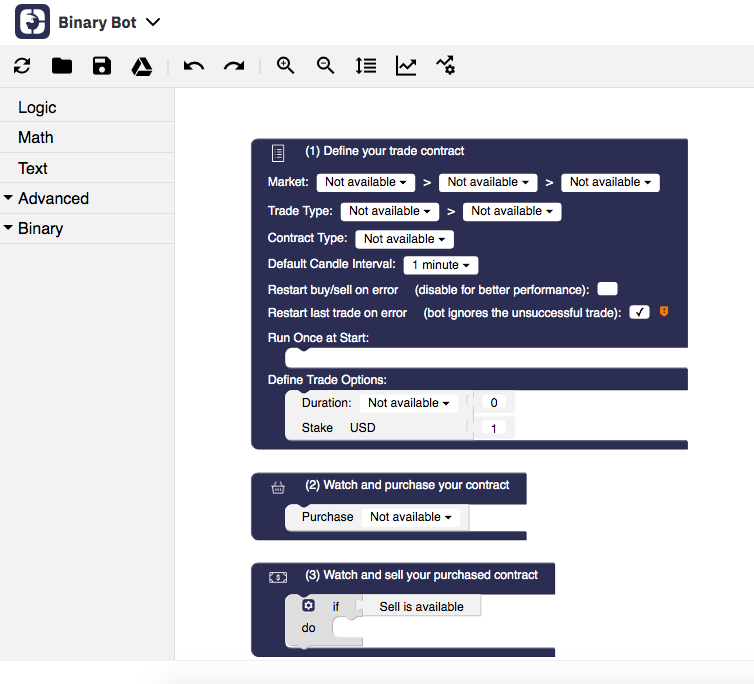

DBot & Binary Bot

The DBot and Binary Bot (options only) tools are automated trading solutions that support 50+ assets. Users can create customized strategies without any previous coding experience. Clients simply drag pre-built trade conditions to create a bot.

There are also three pre-programmed strategies that already exist in the platform. Retail investors can amend the existing strategies or build a setup from scratch.

When we tested DBot, we were impressed with how beginner-friendly the system was. Trade robot creation is pretty self-explanatory, though are several integrated tutorials and reference guides to help along the way.

Trade notifications can also be set once the bot is up and running, displaying performance indicators in real-time.

To get start started:

- Choose an asset to trade

- Input the purchase conditions (e.g. price rise or fall)

- Determine the trading parameters

- Run the bot

- Monitor performance

The Deriv Bot

Other Platforms & Tools

For traders interested in the broker’s other financial products, such as CFDs and Multipliers, there is the MT5, Deriv X and SmartTrader platforms.

These terminals offer straightforward access to popular markets with customizable charts, one-click trading, plus a breadth of technical indicators and drawing tools.

Deposits & Withdrawals

Traders can fund binary options accounts with 30+ payment methods, significantly more than most competitors.

The minimum deposit requirement to open an account is $5, though some payment solutions have individual minimums.

The broker does not charge any deposit or withdrawal fees.

- Bitcoin – No minimum deposit, minimum withdrawal 0.0022 BTC. Processing times are blockchain dependant

- Instant Bank Transfer – USD only. Minimum deposit $5, maximum deposit $50,000, minimum withdrawal $5, maximum withdrawal $50,000. One-day processing time for deposits and withdrawals

- PayTrust – USD only. Minimum deposit $10, maximum deposit $17,000, no minimum or maximum withdrawal amounts. One-day processing time for deposits and withdrawals

- help2pay – USD only. Minimum deposit $15, maximum deposit $10,000, no minimum or maximum withdrawal amounts. Instant processing time for deposits and withdrawals

- Credit & Debit Cards (Visa/Mastercard/Maestro/Diners Club) – USD, EUR, AUD and GBP. Minimum deposit $10, maximum deposit $10,000, minimum withdrawal $10, maximum withdrawal $10,000. Instant processing for deposits and up to one day for withdrawals

- JCB – USD only. Minimum deposit $10, maximum deposit $10,000, minimum withdrawal $10, maximum withdrawal $10,000. Instant processing for deposits and up to one working day for withdrawals

- FasaPay – USD only. Minimum deposit $5, maximum deposit $10,000, minimum withdrawal $5, maximum withdrawal $10,000. Instant processing for deposits and up to one working day for withdrawals

- Perfect Money – USD and EUR. Minimum deposit $5, maximum deposit $10,000, minimum withdrawal $5, maximum withdrawal $10,000. Instant processing for deposits and up to one working day for withdrawals

- Neteller – USD, EUR, AUD and GBP. Minimum deposit $10, maximum deposit $10,000, minimum withdrawal $10, maximum withdrawal $10,000. Instant processing for deposits and up to one working day for withdrawals

Note, our experts found that availability varies between countries.

Live Account

Deriv does not offer multiple account types, which may be a downside for active traders that can benefit from discounts and rewards with VIP accounts elsewhere

The standard profile provides eligible customers with access to all trading products, including binary options.

How To Open A Deriv Account

- Follow the ‘Visit Broker’ or ‘Go To Deriv’ buttons in this review – this will automatically open Deriv.com and prompt you to open an account

- Enter your email and accept the terms and conditions

- Final account sign-up instructions and credentials will be sent to the registered email address

- Use your new credentials to log into the Deriv client area and start trading

Note, you can also sign up using an existing Google, Apple or Facebook account.

Demo Account

Deriv also offers a free demo account. Prospective investors can trade with unlimited virtual funds in real-market conditions. There is no time limit and all of the broker’s platforms and trading tools are available in the demo environment.

When we used Deriv, we found the paper trading profile was particularly useful for getting to grips with the automated strategy builders.

New users can sign up for a practice account with just an email address.

Deriv Regulation

Deriv’s various global entities are registered with several regulators:

- Deriv (V) Ltd – Licensed by the Vanuatu Financial Services Commission, 14556

- Deriv (FX) Ltd – Licensed by Labuan Financial Services Authority, MB/18/0024

- Deriv BVI Ltd – Licensed by the British Virgin Islands Financial Services Commission, SIBA/L/18/1114

It is worth pointing out, however, that these are not top-tier regulators.

On a more positive note, limited regulatory oversight is common in the binary options space and Deriv segregates client money from company funds.

Additional Features

Deriv.com doesn’t offer a wealth of educational resources for binary options trading. The Academy has some information regarding forex and CFD trading but is limited when it comes to options investments.

With that said, there are some useful trading tool guides and step-by-step instructions on how to use the platforms.

Trading signals are also available on the MT5 platform. Clients can subscribe to multiple signal providers to receive potential trade suggestions, including entry and exit points. Traders can then choose whether to copy the trade into their own account.

In addition, various calculators are available for free on the broker’s site, including a margin calculator, a swap calculator, a pip calculator, and a PnL for margin.

Finally, an active investor community and trading forums mean users can interact, exchange trade ideas or troubleshoot problems with platforms and tools.

Pros Of Trading Binary Options With Deriv

- Up to 100% payouts

- Trade options from $1

- Demo account with virtual funds

- 30+ deposit and withdrawal methods

- Choose from three option products; digital options, lookbacks, and call/put spreads

- Binaries can be traded on forex, commodities, indices, derived synthetics, and baskets

Cons Of Trading Binary Options With Deriv

- No copy trading

- Weekend customer support is limited

- Limited bonuses and financial incentives

- Options trading is unavailable to retail investors in the UK, EU & some other countries

Customer Support

Customer support at Deriv is adequate. There is no email address or telephone contact number. Instead, the broker offers WhatsApp and live chat, available 24/7. Additionally, Deriv maintains a detailed FAQ page.

When our experts tested the live chat on the weekend, the service was hosted by a bot only and we were unable to speak to a customer agent.

Client Safety

The broker uses SSL technology for all personal data transmissions and financial transactions. Traders can also enable two-factor authentication (2FA) for additional account protection.

In addition, Deriv.com has a big focus on responsible trading. Customers can set limits on trading activities and self-exclude from some products. This includes limiting the amount of money that can be traded and losses within a period.

Should You Trade Binaries With Deriv?

Deriv offers good binary options trading conditions with over 100 underlying assets, proprietary platforms and tools, plus payouts of up to 100%. Alongside binary options, forex and CFD trading is also available.

On the downside, customer support options are limited and Deriv is unavailable to traders in some countries, including the US and Canada.

Overall, Deriv is a good fit for new and experienced binary options traders, especially investors that are also interested in other financial products like CFDs.

__

Deriv offers complex derivative products, such as options and contracts for difference (“CFDs”). These products may not be suitable for all customers, and trading them may expose you to risks.

Please ensure you fully understand the following risks before trading Deriv’s products:

a) you may lose some or all of the money you invest in trading,

b) if your trade involves currency conversion, exchange rates will affect your profits and losses. You should never trade with borrowed funds or with money that you cannot afford to lose.

__

FAQ

Can Deriv Be Trusted?

Deriv is a trustworthy binary options broker. Previously Binary.com, the brand has 20+ years in the market and is registered with various regulators, including the LFSA, MFSA, VFSC and BVI.

Deriv also offers various account security measures and segregates client funds.

Is Deriv A Good Or Bad Binary Options Broker?

Deriv offers a low minimum deposit, proprietary trading tools, and a wide range of binary options products. However, the broker does not offer welcome bonuses or binary options copy trading, which are offered by some alternatives, including Pocket Option.

Overall though, Deriv is still a good all-round broker for aspiring binary options traders.

Is Deriv Regulated?

Deriv holds licenses with several regulators, including the Vanuatu Financial Services Commission, Labuan Financial Services Authority, Malta Financial Services Authority, and the British Virgin Islands Financial Services Commission.

However, it is worth highlighting that these are not particularly reputable regulators and traders will receive limited protection vs the oversight provided by tier-one financial watchdogs.

What Platforms Can I Trade Binary Options On With Deriv?

Binary options investors can use the DTrader, DBot, and Binary Bot. These are available as desktop downloads and web traders. Deriv also hosts useful user guides and tutorials on its website.

Does Deriv.com Offer A Demo Account?

Yes, Deriv offers a free binary options demo profile. Retail investors can practice trading risk-free with unlimited virtual funds and no time constraints. Traders can sign up with just an email address and upgrade to a real-money account when they feel ready.

Deriv Details

| Awards |

|

|---|---|

| Instruments | CFDs, Multipliers, Accumulators, Synthetic Indices, Forex, Stocks, Options, Commodities, ETFs |

| Demo Account | Yes |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Payout | 100% |

| Expiry Times | 15 seconds to 365 days |

| Ladder Binary Options | Yes |

| Boundary Binary Options | Yes |

| Payment Methods |

|

| Regulator | MFSA, LFSA, BVIFSC, VFSC, FSC, SVGFSA |

| Mobile Apps | iOS & Android |

| Auto Trading | Expert Advisors (EAs) on MetaTrader, DBots |

| Copy Trading | Yes |

| Social Trading | No |

| Margin Trading | Yes |

| MetaTrader 4 | No |

| MetaTrader 5 | Yes |

| cTrader | Yes |

| AlgoTrader | No |

| OmniTrader | No |

| TradingView | Yes |

| Autochartist | No |

| eSignal | No |

| Trading Central | No |

| STP Account | No |

| ECN Account | No |

| DMA Account | No |

| MAM Account | No |

| PAMM Account | No |

| LAMM Account | No |

| Demat Account | No |

| AI / Machine Learning | No |

| Robo Advisor | No |

| Negative Balance Protection | Yes |

| Market Maker | Yes |

| P2P Trading | No |

| Spot Trading | Yes |

| Trade Signals | DMT5 |

| VPS Hosting | No |

| Tournaments | No |

| Demo Competitions | No |

| Ethical Investing | No |

| Islamic Account | Yes |

| Account Currencies |

|

| Stock Exchanges |

|

| Commodities |

|

| CFD Trading | Yes |

| CFD Leverage | 1:1000 |

| CFD FTSE Spread | 1.28 |

| CFD GBPUSD Spread | 1.4 |

| CFD Oil Spread | 0.02 |

| CFD Stocks Spread | 0.59 (Apple) |

| Forex Trading | Yes |

| Forex GBPUSD Spread | 1.4 |

| Forex EURUSD Spread | 1.4 |

| Forex EURGBP Spread | 1.0 |

| Forex Assets | 40+ |

| Crypto Trading | Yes |

| Crypto Spread | From 0.5 |

| Crypto Coins |

|

| Crypto Lending | No |

| Crypto Mining | No |

| Crypto Staking | No |

| Crypto Auto Market Maker | No |

Compare Deriv

Compare Deriv with any other broker by selecting the other broker below.