Dollar Poised for Big Moves as Fed’s Meeting Looms

What’s On Tap For The Dollar This Week?

by Bogdan Giulvezan

The US Dollar Index (DXY) has been sneaking higher throughout July but the greenback is showing a mixed bias going into the final week of the month. The last few days have been almost flat against the Euro but the Dollar made notable advances against the Yen; however, the Pound has been gaining ground, climbing from last week’s low of 1.3572 to a high of 1.3787.

The story of the week will be the Fed Meeting scheduled for Wednesday and according to strategists from the Commonwealth Bank of Australia (CBA), the dollar may strengthen if the Fed will show a willingness to move closer to tapering. According to CBA’s Joseph Capurso, as reported by Reuters: “We expect the FOMC to drop ‘substantial’ from ‘substantial further progress’,” which would suggest that the next step is tapering asset purchases. Besides the FOMC Meeting, the US Dollar has a busy week ahead, so let’s take a closer look at the potential market movers.

Tuesday, July 27 at 2:00 pm GMT the Conference Board Inc. will release the Consumer Confidence survey, which is expected to drop from last month’s 127.3 to 124.2. The survey is derived from the opinions of about 3,000 households and acts as a leading indicator of consumer spending, which is a big part of the overall economic activity.

The FOMC Statement comes out Wednesday, July 28 at 6:00 pm GMT and will contain the result of the interest rate votes, as well as details about the reasons that influenced the decision. More importantly, it may contain clues about tapering or future monetary policy and if that’s the case, the greenback will surely react vigorously. Half an hour later, at 6:30 pm GMT, Fed Reserve Chair Powell will hold the usual press conference, which will probably add more volatility.

On Thursday, July 29 the Advance GDP report is due, showing changes in the total value of services and goods produced by the U.S. economy and the final event of the week will be the Core PCE Price Index scheduled Friday at 12:30 pm GMT. The index tracks changes in the price that individual consumers pay for the goods and services they purchase and it is rumored to be the Fed’s main inflation measure. The expected change is 0.6% while the previous was 0.5%.

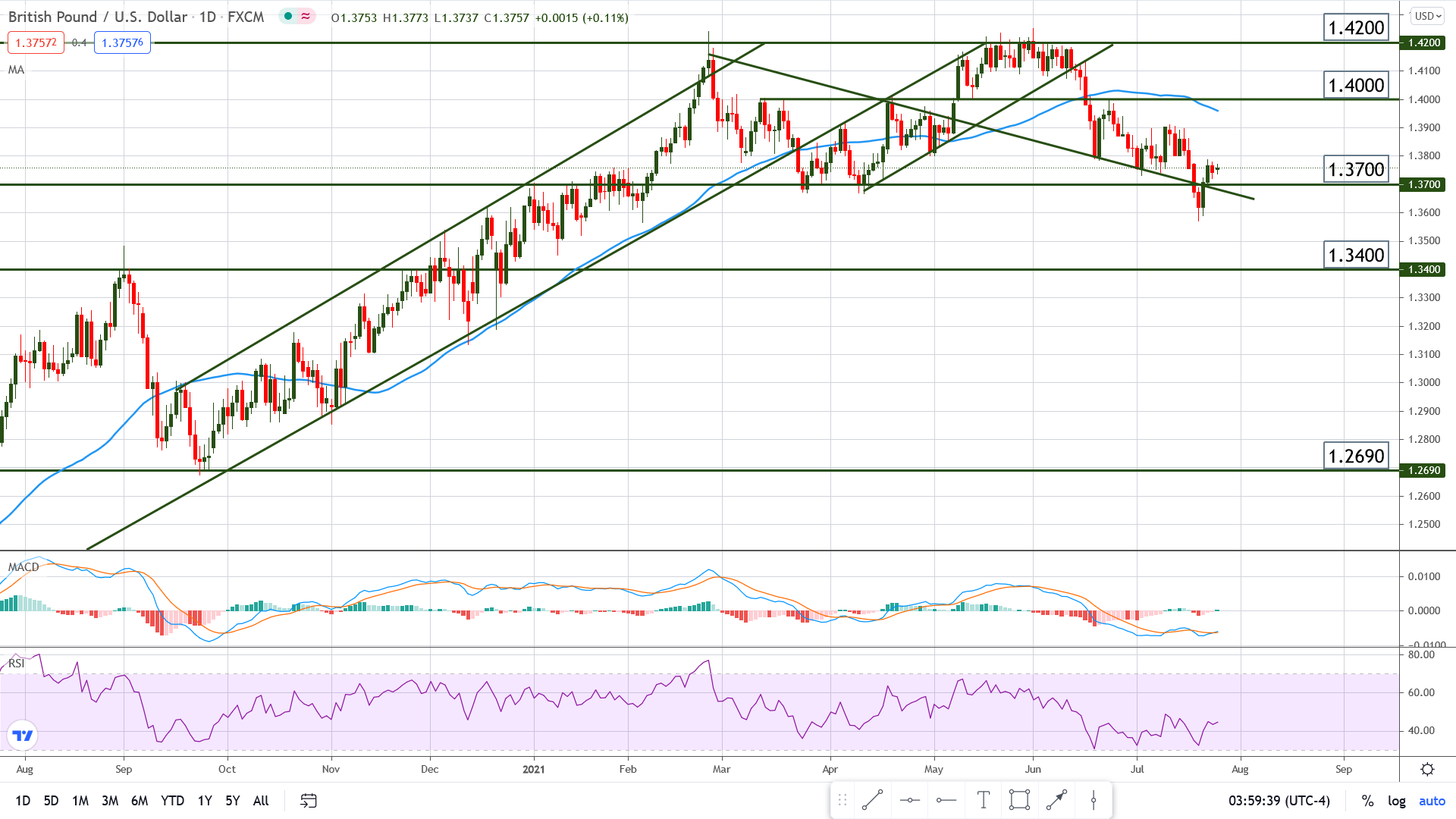

Technical Outlook – GBP/USD

At the time of writing the pair is trading at 1.3760 and seems to be headed up after a false break of 1.3700 support. Price also dipped below a long-term trend line that acted as a strong barrier in the past (price bounced off it multiple times, from above and below).

The confluence zone created by the two technical elements (diagonal and horizontal support) acted as a springboard that is likely to drive the pair higher, possibly into the 50 days Moving Average and the previous high at 1.3900. Of course, the fundamental side will play a major role this week, considering that the US Dollar will be affected by major data releases.