Equity Option Strategies, why?

In “An ace on the River” Barry Greenstein talks about an important poker concept that is the basis for why you should be interested in trading traditional options as well as Binaries, Forex & Futures. It’s the idea of perfect play vs correct play. If you knew your opponents cards at each point in a hand (and had a good idea of how he/she plays) you could play perfectly. You do not know your opponents cards, but you can deduce a range of hands based on how the hand evolves. Correct play is to play your hand – and it’s likely development as more cards are dealt – against your opponents likely range of hands & it’s likely development.

In trading if you knew where the market was going & when you could trade perfectly, taking as much leverage as is possible and tailoring your strategy to maximize your outcome. If you know a huge move is imminent Forex or a back-ratio spread or traditional puts or calls are going to be optimal, if it’s a small one put your entire account on a BO … But since we’re not ever sure of market outcome it’s correct to make a wide range of strategic bets.

The value of equity option positions is that they can be constructed & managed such that they are very high probability trades but can still offer large returns. They are considerably more forgiving than straight directional bets because they have ever-changing time value that you can buy and sell. Buying and selling this time value is known as a “strategic overlay” because it’s a layer of profit/loss in addition to direction of the underlying asset and can be constructed to profit in a wide range of scenarios.

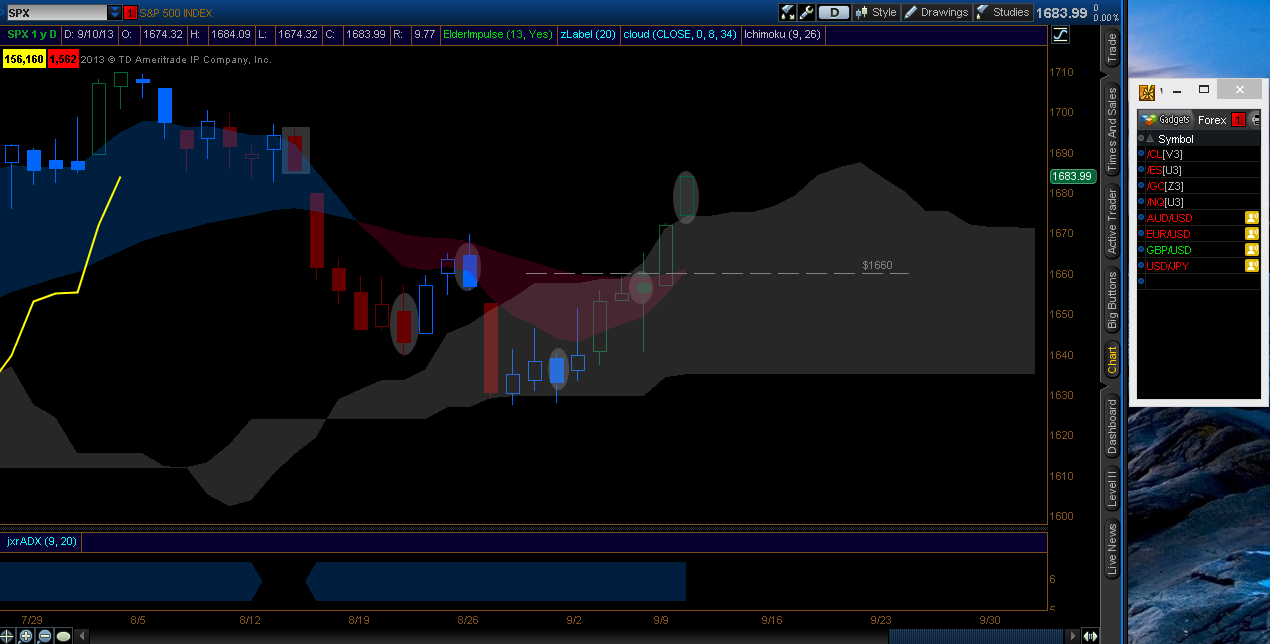

This is a daily chart of the SPX, end-of-day Sept 10. The highlighted red candle on the left is August 14th. At that point it’s reasonable to assume that there will be some kind of sideways to down movement into the Kumo over the next couple weeks. Over the next several posts I’ll illustrate various ways to trade this two-week period using options at various strikes & expirations as well as ES futures as a hedge.

If you’re reading this – make comments, ask questions. Hopefully it will be a good learning experience for you & for me.