EUR/USD Binary Options Trading for July 10, 2014

As has been customary this summer, more support and resistance trading mainly through the primary use of pivot points as my guiding influence was the basis behind today’s trading.

The pair made a steady decline back down toward the daily pivot level of 1.36324 around the beginnning of the 3AM (EST) hour. It came agonizingly close to touching it on the 3:05 candle, but stopped short. For those familiar with my style of trading, I was of course looking at the pivot level in this case as a potential reversal point in the market, a potentially viable place to consider call options.

I did get the touch of 1.36324 a half-hour later on the 3:35 candle, just barely. I didn’t get another re-touch another half-hour later, and instead of getting into a call option trade, I decided to wait for another rejection. I wanted some sort of price action cue to determine whether this level would continue to hold or not considering the last touch was thirty minutes prior. When price did reject the pivot level once again, I got into the call option upon the re-touch on the 4:10 candle. Waiting for a later expiry rather than taking the trade immediately on the 4:05 candle turned out to be the best decision. Price settled just under the pivot level for a little while before coming back up for a two-pip winner.

After this, I essentially got back into the same trade on the 5:10 candle. The market wicked below the pivot on the 5:05 candle before ultimately forming a doji. Dojis (little to no body on the candle) typically denote indecision in the market (and sometimes poor liquidity of course) and can be a quality price action signal for a reversal. The 5:10 candle wicked back below the pivot and closed below. This told me that a break of the pivot would be likely soon. Not necessarily now, but a break in the near-feature seemed probable. During this particular trade, the pivot did hold, and gave nearly a four-pip winner.

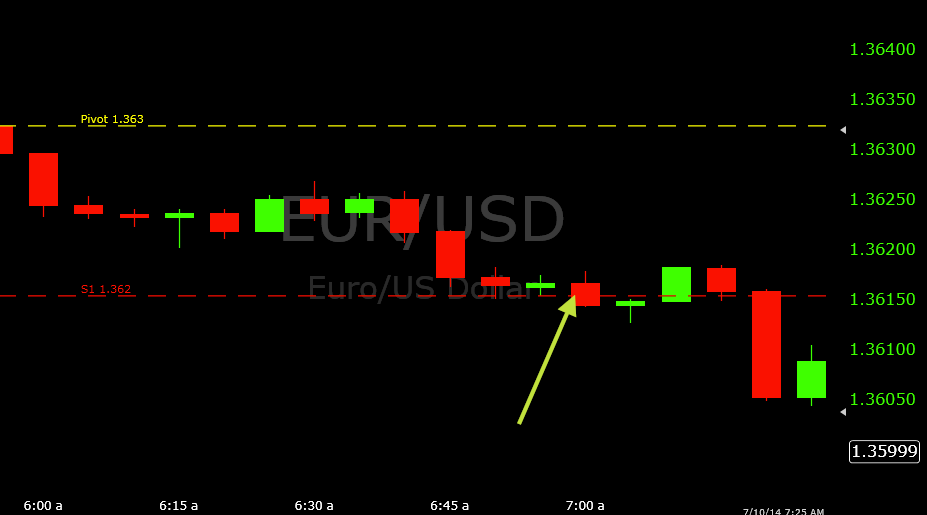

Price did make a move down below pivot just before 6AM. It kept falling and while I wasn’t sure if the support 1 level of 1.36154 would provide any possible trade opportunities. I considered that the downtrend might continue into possibly the U.S. morning open or simply provide set-ups too risky to take.

But fortunately I was wrong on this prediction and a quality call option set-up did emerge. There was price congestion in the middle of the pivot level-support 1 channgel followed by another bearish move down. But the momentum slowed down as 1.36154 was approached. I got a touch and rejection of support 1 on the 6:50 candle, but I wanted further confirmation before entering a call option due to a relatively strong recent drop in the pair. I wanted to be sure that the likelihood of the selling halting at least for a moment would be good enough to at least consider a trade. Once I got another rejection of support 1 on the 6:55 candle, I decided to get into a re-touch on the 7:00 candle if it occurred, which it did.

I did get a winner on this one of about three pips. But sure enough, the downtrend did continue with a breach of 1.36154 just over five minutes after the trade’s expiry. At this point, I was content with the 3/3 ITM day and decided against trading further. After an 0/2 start to this week, I have my last seven trades, which I can definitely be quite happy with.