EUR/USD Binary Options Trading for July 2, 2014

Wednesday’s trade came at around 2AM EST. Naturally, at this point, volatility is only slightly heating up in the market, as it’s still only the early morning even in Europe. One of the nice things about trading quieter hours is that the news doesn’t interfere too heavily with your trading. For anyone who trades predominantly on technical cues, as I do, the news can be a detriment in some respects because it can force you to stay out of the market. Before trading any asset, always consult an economic calendar for that day to understand what types of events can influence the market you’re trading. For instance, in the U.S., data on the state of the economy is often released at 8:30AM EST, and can affect all currency pairs – and equities and futures markets to name further examples – given how intertwined the world’s financial system is. Moreover, when trading short-term binary options, even a release of fairly unpopular economic data can alter the direction of a market enough to produce a losing trade.

On to today’s trade…

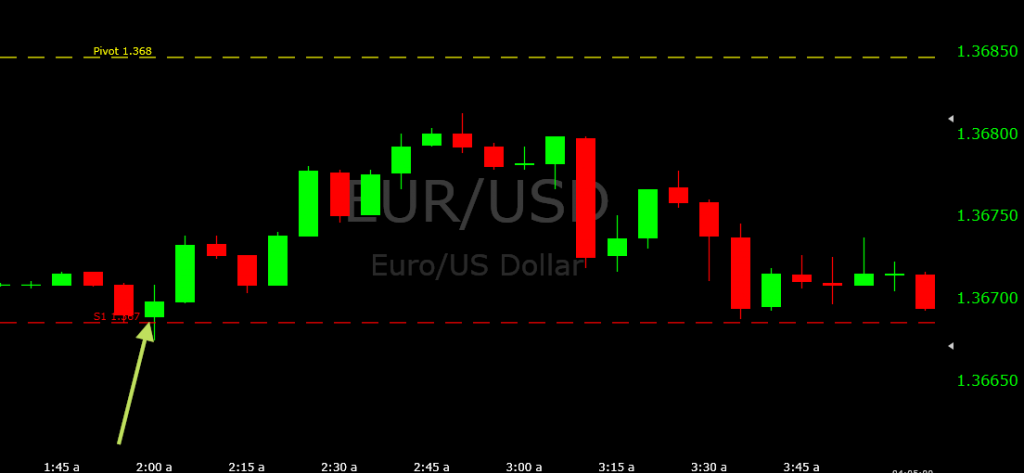

The one price level I had my eye on immediately was the support 1 level of 1.36685. Price came close to touching here just before 1AM EST and came within a few pips of it around a half-hour later. I did not really consider these dips to be worthy support levels; they were very weak at best. What I wanted most of all was a challenge down to 1.36685.

When price came down and touched support 1 on the 2:00 candle, it bounced, and based on how price was hovering, it seemed likely that 1.36685 would hold. When price re-touched on the following candle, I got into a call option. This wasn’t a trade I was necessarily excited about. Just had the level and some hesitancy in the price action to go off of to validate this set-up. Yet it’s still a trade you might expect to win maybe 60% of the time, in my estimation. So in theory, similar probabilistic scenarios like this should lend profitable results over time. I was expecting a very small winner, but I was able to not only get a bit of upward movement on the entry candle, but also on the following one, as well, for a 4-5 pip winner.

From this point on, I was considering potential put options at the pivot point, but price fell around five pips shy of reaching this level despite my initial expectations. After this peak, the market continually fell. I would have possibly considered further call options at support 1. It came close to challenging it after 3:30AM EST, before retracing weakly back up. This suggests weak buying action on the pair and, not so surprisingly, once price retouched support 1 it fell through the level to make new lows.

Despite a short-lived surge back up to support 1 after 4:30AM, price continued to fall and nothing set up cleanly on the support 2 line. At this point, if a market clearly has the desire to trend lower and nothing is setting up at potential support/resistance levels for reversals, then based on the way I trade, I’m much better off staying out of the market altogether. It’s never smart to bet against a trend unless you have strong reason to do so. And I’m not the type of trader that takes random entries with the trend given there are always blips/mini-retracements that occur that can produce losing trades despite how strong a prevailing trend might be.

I did not trade any longer after this and simply accepted the one winning trade as my sole output for the day, which I am always okay with.

The best trade set-ups following, however, occurred right around this 8:30AM EST timeframe. Price made it through support 2 and began testing support 3. As you can see from the image posted below, some good call option set-ups could have been had. Two decent call option set-ups strike me as strong trading possibilities.

Moreover, I have regularly found the high and low pivot points – resistance 3 and support 3 – to be pretty good reversal areas. Usually when price gets to these levels, the market has proceeded to move so far in one direction, that it’s natural for the market to reverse course or take a breather temporarily due to the aggressive degree of buying or selling that’s been seen. Oftentimes, there may not be enough figurative gas left in the tank to sustain the movement immediately and, for the moment, reverse course. Overall, daily pivot points can be very useful guides in your trading to determine these potential reversal points and that’s why I’ve been using them more heavily now than at any other point in my binary trading.