EUR/USD Day Trades – October 8

I am continuing to trade a new forex trading strategy, and was able to get in two trades this morning before switching to another market.

I’ll continue to expand on the strategy and provide more details, in addition to what was shared in the Forex Day Trades – October 7 post.

When to Trade

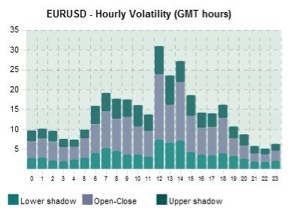

The strategy works best during the European and/or European and U.S overlap period. Once Europe closes we generally a see bit of a slowdown. As figure 1 shows, volatility is greatest between 6 GMT and 15 GMT. Trades with a strategy such as this should take place inside of these times, as the profit targets are generally pretty small as is, so trading during quiet times means the rewards won’t justify trading.

Between 10 and 15 GMT seems to be the ideal time to trade this strategy.

Figure 1. EUR/USD Hourly Average Volatility

Trade Examples

The first trade I took occurred during the European and US overlap period. The trend was up overall (referring to a 5-minute chart), and after creating a new short-term high the price drifted to the side and slightly lower. Such pullbacks provide ideal entry opportunities as risk will generally be quite small.

Figure 2. EUR/USD Trade 1 – 1 Minute Chart

The trade was taken at the lower band, which as indicated in the prior post is just an “envelope” set to 0.01% on a 1-minute chart. The small up arrow marks the entry bar. The initial stop is set at 3.5 pips, but was quickly moved in to 2 pips once the price began to move higher.

The target is based on Fibonacci extensions. Using the prior wave higher to draw our extension, we look to exit at the Fibonacci level closest to the former high (in a downtrend we would look to exit at a Fibonacci level close to the former low). As it turned out, the 61.8% level is right near the former high so an exit is taken and a 3.4 pip profit locked in.

Since there are so many potential trades utilizing this strategy, there is little need to get greedy and try to make more. Take profits and look for another entry.

This strategy is a “scalping” type strategy. We are trading trends, but for small repeating moves. This means you’ll need a very tight spread to trade the strategy on a 1-minute chart, otherwise you’re better off using a 5 minute chart with a 0.015% envelope to capture bit bigger moves.

Another long opportunity came several minutes later. This one is a bit more complex.

Figure 3. EUR/USD Trade 2 – 1 Minute Chart

Following a strong run-up–some of it was captured on the last trade–there is a sharp pullback which pierces the lower band. Enter long at the lower band with an initial stop at 3.5 pips.

That stop is placed at the time of my entry order. It is a worst case scenario stop and assures I have some sort of loss protection in the market if I lose my internet connection or a scenario like that. Usually this stop will be reduced very quickly, but it is important to place it with your entry order.

Even with a sharper pullback, the price doesn’t move too far past the band. The stop is reduced to 1.9 pips–just below the recent low–once the price begins to move higher again.

The target is based on the prior price wave, which was a big one, so our target is also bigger on this trade utilizing the Fibonacci levels.

As the price moved up toward my target the first time it didn’t hit it, and then pulled back. At this point the stop and target stay where they are. The price then begins to move higher again. Since this creates a new higher low, the stop is moved up to just below this low, locking in at least a 2.3 pip profit. The price continued to consolidate for a bit but then hit the target resulting in a 6.8 pip profit.

Trade Considerations

This style of trading is highly reliant on the trend. We are keeping risk very small, so if you trade the strategy against the trend, there will be lots of losing trades. For more on how to determine the trend, read Capitalizing on Lower Highs and Higher Lows in Price, as it provides more information on trends.

I also recommend being selective with your trades. There are lots of signals produced, but not all are worth trading. Take only those where the reward is like to outweigh your risk. Also place a stop with your entry order, and reduce the stop level as soon as the price begins to move in your direction. And finally, don’t get greedy with targets. There is lots of opportunity, just take the exit closest to the former price high or low.

For my next post I will attempt more trades on the 5 or even 15 minute chart, as likely many of you will be trading on that time frame.