GBP/JPY Trading for July 8, 2014

Tuesday offered a very trade-able market, with a decent amount of volatility and trades setting up well right on expected points of resistance.

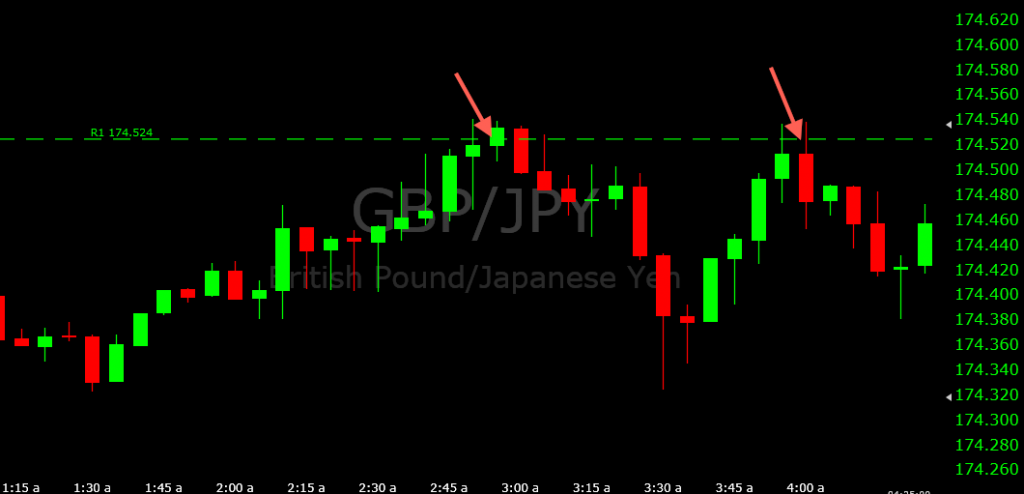

The first trade came at the resistance 1 level of 174.524. A touch of 174.524 had become pretty readily foreseeable for the past fifteen minutes with the market moving up on the few candles preceding the touch. The first wicked back down, followed by a higher wick on the second candle, which in turn was followed by a five-pip bullish candle. This suggested that the buying efforts would be likely to at least reach this particular pivot point. Given there was already some resistive force to the buying denoted by the top wicks, I figured it would be unlikely that price would be able to break resistance 1 at this time.

So when resistance 1 was hit on the 2:50(AM EST) candle, it was expected that it would wick back down, which it did. I got into a put option on the re-touch on the 2:55 candle and despite initially going a pip or so out of favor, I eventually had a five-pip winner by expiration.

My second trade set up in a similar manner. The pair retraced back down fifteen pips from 174.524, which indicated that selling was still the general preference in the market. As I like to emphasize every now and then in my trading articles, whenever you have a weak retracement off a price level of interest, perhaps one where you already took a trade, it denotes that that particular point in the market is likely to be broken on the next touch. The dynamics of the scenario frequently imply that, say in the case of a resistance level, the selling that occurred after the bounce was weak and not enough to sustain a downward movement. This usually means that the buyers are exerting enough force in the market to cause an eventual breach of that price level. But in this case, a retracement of fifteen pips was clearly indicative that selling was still strong in the market and resistance 1 could still be an area worthy of further put option set-ups.

When the pound/yen rejected its resistance 1 level again on the 3:55 candle, I was definitely willing to get back into another put option on the re-touch, which I did on the subsequent candle. This produced an even more definitive winner than the last trade (more trading volume helps), with about a seven-pip winning margin.

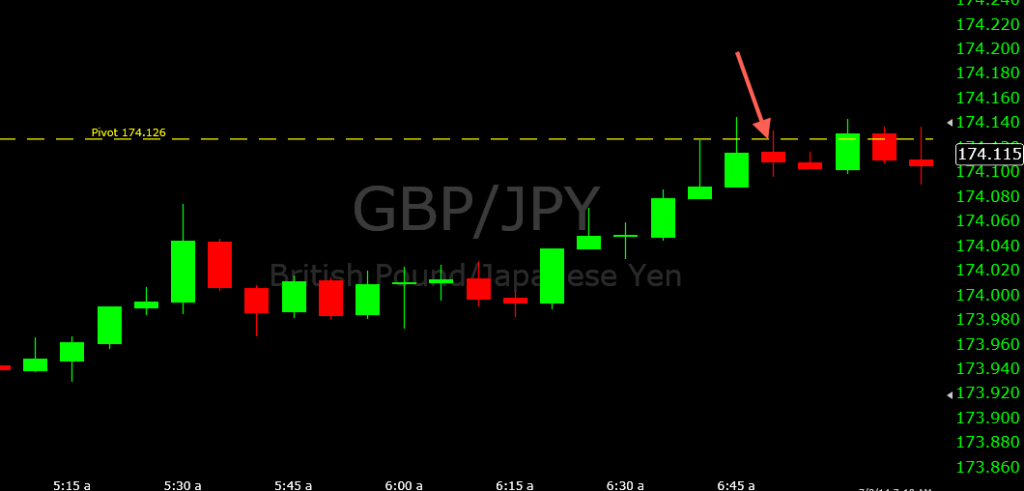

Selling continued after this trade, including a big 39-pip drop on the 4:35 candle, causing price to fall below the pivot level of 174.126. Naturally, when you have a clear selling preference in the market, one’s attention might rationally follow that put options should certainly be preferred. In this case, the pivot level was the most logical area for possible put option set-ups.

It took over two hours for my alert to inform me of price getting up to the pivot (or down to support 1, which didn’t happen and would’ve likely been a lower-probability play as a call option anyway). But when it did another nice put option set-up formed.

The first touch was on the 6:45 candle, and I got into the trade on the re-touch on the 6:50 candle, producing a winner of over two pips by its expiration at the top of the hour (denoted by the close of the 6:55 candle).

Overall, this day worked out beautifully. Three very high-probability set-ups with all three going in the money. Based on my estimation, trades of these kind are those that will usually work out about 80% of the time. The first trade was solid yet had the lowest odds, given no precedent had yet to be set at resistance 1, while the final trade had the greatest odds, based on the clear wave of selling that was occurring. But it was nice to bounce back after the 0/2 day on Monday.