Picking the Best Instrument to Trade

Some instruments move together, while others move in opposite directions and some share no relationship whatsoever. Such relationships can play a key role in determining which trades you make and why. While you may not be aware of it, when you get a trade signal in one instrument, signals are also likely triggering in other markets which may present a greater chance of a success. If you trade forex, or forex options this is often the case. With so many pairs, most binary trades you make will have at least one of two substitutes that you could trade instead. By understanding relative strength and weakness you’ll be able to pick the best market to take your long/call or short/put trades respectively. Compare any instrument to another to see which is the better instrument to trade.

Correlation and Comparing Markets

Say you look at the USD/JPY price chart and see a potential trade, and also happen to notice one on the EUR/JPY chart as well. This is quite likely as these two forex pairs share a high correlation (at the time of this writing). A correlation is how closely the movement of one asset mimics another, with a high correlation of 90 to 100 meaning the markets move in a very similar fashion. A correlation of -90 to -100 means the markets move in the opposite direction to each other.

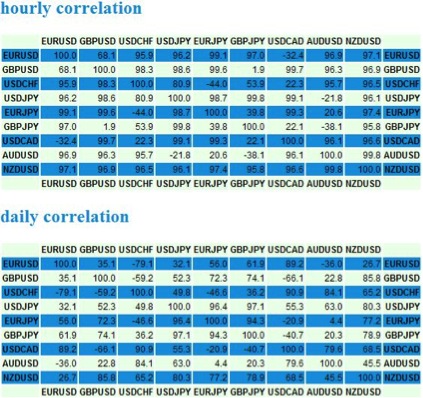

Based on my May 2, 2013 correlation data (updated regularly here: Forex Daily Stats) there are a number of forex pairs which have high correlations to each other.

On the shorter time frame, there are many strong correlations. Although, these short-term correlations are not very reliable, therefore the daily correlation provides a more accurate picture of which pairs are moving together and which are not.

Here are some of the strong correlations (90+) worth noting:

USD/CHF and USD/CAD at 90.9

Since these pairs are trading with a high correlation, one pair could be used a substitute for the other. For example, one may provide a slightly better opportunity than the other. If you see a trade in one, check the other as well. In the next section we’ll go over what to look for.

USD/JPY and EUR/JPY at 96.4

USD/JPY and GBP/JPY at 97.1

EUR/JPY and GBP/JPY at 94.3

The JPY is moving similarly against the USD, EUR and GBP. Therefore, if making a trade using a Yen (JPY) pair, look at the charts of other Yen pairs to see which is likely to provide you with the most successful trade based on which direction you want to go, long (call) or short (put).

Finding Strength

You’re checking your charts, looking for trades, and you see the following:

While you may not trade the daily time frame, and prefer shorter term trades, the massive uptrend grabs your attention and gets you thinking about taking a long position/buying calls in the USD/JPY.

But you now also know, based on the correlations, that the EUR/JPY and GBP/JPY are likely moving in a similar fashion. Now you have a choice. Which pair provides the higher probability for going long/buying calls?

Often picking the one which is showing relative strength is the best choice. Relative strength is simply the strongest of the possible choices, often determined by percentage increase, or the ability to continually generate higher highs and higher lows (while another of the choices may not be able to).

One way to easily compare the performance of assets is to use the Comparison setting on www.freestockcharts.com.

Overall the chart shows the EUR/JPY (purple) and USD/JPY (green) have been stronger than the GBP/JPY. But that may be changing as the GBP/JPY is approaching its recent highs, while the EUR/JPY and USD/JPY have fallen off their respective highs. If the GBP/JPY breaks to a new high before the other pairs do, it will be showing relative strength and therefore presents a relatively good trading opportunity compared to the other two on a short-time frame.

Overall though, since the USD/JPY and EUR/JPY have been stronger over the long term, if the weaker GBP/JPY breaks higher, it could be a good opportunity to go long the USD/JPY or EUR/JPY as the historical precedent here (which could change at any time) is that they will continue to outperform the GBP/JPY.

Finding Weakness

When you find a short or put trade you like, the same concepts apply except you’ll want to take the trade in the weakest of the choices.

Let’s use the same pairs, and decide which is weakest over a few day period.

Since the start of this week, the USD/JPY (green) has consistently underperformed the EUR/JPY and GBP/JPY showing that on this timeframe it is weaker. Notice also how the USD/JPY continually makes lower lows and lower highs, while the other two pairs haven’t (they’ve been stronger).

If you were looking take a short position in either the USD/JPY, EUR/JPY or GBP/JPY, based on this evidence the best choice would be the USD/JPY.

Final Word

Relative strength is a tool to be used in conjunction with your trade strategies. You may get a signal in one pair, but if you know that pair is highly correlated to others, check those pairs as well as they may present a better opportunity. Ideally you want to always be buying (calls) in the strongest assets and shorting or buying puts in the weakest ones. Remember though, what is weak or strong one day, may not be the next. Don’t simply trust historical tendencies, but rather monitor them in real time by comparing the movement of one asset to another. This is a more advanced technique, but can pay big dividends as it may keep you on the right side of strong and weak markets.