Strong Monday Trading on the EUR/USD (3/3 ITM)

The most recent Mondays haven’t been overly kind regarding my personal trading results. In fact, I know that over the previous two Mondays I have gone 0-for-5 ITM on my trading results. :( But today, I was able to start out the week well.

The first trade came at resistance 1 – 1.35427. In the couple hours preceding the European market open (2AM EST), price had been congesting around this level. Once the volume began to show up at 2AM, price began to move down to the daily pivot level of 1.35337 and came one-tenth of a pip from hitting it. There was merely a nine-pip discrepancy between these two price levels – and just under five pips between pivot and support 1 (1.35290) – so it wasn’t a surprise that there could be some potential for some early trade set-ups.

When price made its way back up to resistance 1 there was a rejection of it on the 2:50 candle, my typical price action cue that a price level is robust enough to potentially trade. I got into a put option, expecting price to fall, on the re-touch of the 2:55 candle. This trade worked beautifully, with another rejection and a strong drop on the following candle. This move continued on the candle after, moving swiftly through the pivot level and even temporarily below support 1.

At this point, I was content to simply let the market settle and see where it would go next. No real need to consider trades at a point where the market is moving with quick drops and moves through pivot points and big wicks back up and all that.

Right after this, the pivot acted as a resistance level, as things were simply cooling down briefly before the downtrend would resume. No trade was taken at the pivot level, as I wasn’t entirely sure if this would merely be a resting point before a resumption of this down-move that seemed to hold some legitimacy or if the market had interest in coming back up above the pivot. So I waited until the market decided what it wanted to do.

It eventually did fall, went through support 1, briefly stalled and even challenged up against support 1 as a resistance level like it had just done to the pivot. It wasn’t until the down-move to support 2 that I was able to find a set-up I was comfortable in taking.

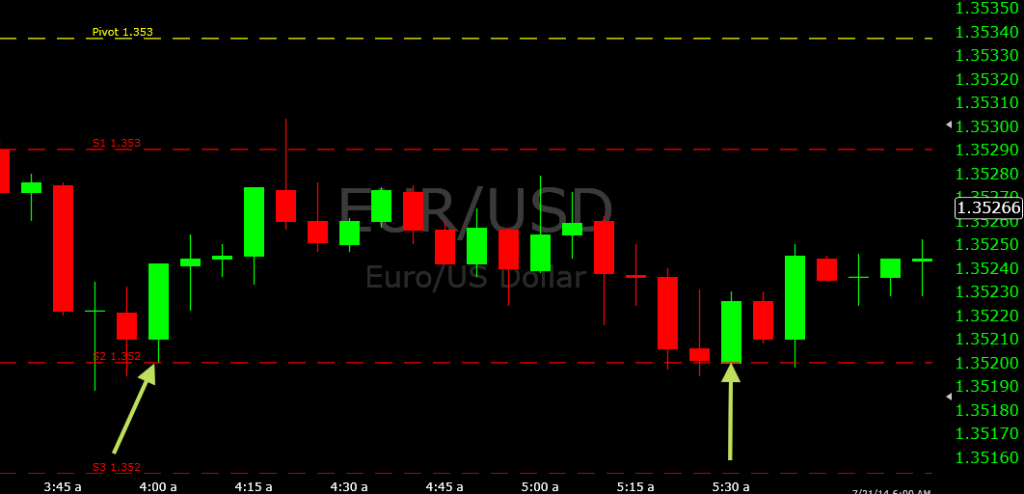

Support 2 was located at 1.35200 and a challenge of that level resulted in a nice doji candle with a strong lower wick. Still, given the ongoing trend, I wasn’t entirely sure that this would be the point at which the market would reverse course – at least temporarily such that a winning trade via a call option would be feasible. It certainly wouldn’t have been surprising if another red candle went right through 1.35200.

But I was able to get a rejection of support 2 again on the following candle, so I sincerely considered getting into the call option set-up. Once price re-touched yet again on the 4:00 candle, I felt confident enough to take a call option. And this trade also worked out very well, winning by over seven pips.

What I really wanted next was a put option set-up at support 1 (1.35290). This would have been a very nice type of set-up given the strong prevailing downtrend. Alas, it didn’t materialize to my liking as I only got the single touch of the level on the 4:20 candle before it began coming back down to 1.35200.

I did debate whether it would be worth it to get back into a call option at support 2 for the simple reasons that the downtrend was strong and the more times a level is tested on separate occasions (i.e., goes up and subsequently falls to challenge it again), the less likely it is to hold. My thinking behind this – and just through my own personal experience – is that if a level is getting tested repeatedly, there is definite selling interest (in this particular case, buying in the event of an up-move). Eventually these sellers are bound to have enough force to break a support level if they hold the ability to get price there on multiple occasions in the first place.

But like everything in trading, each individual scenario is different although experiences from previous markets can help guide one’s opinion. In this instance, price rejected 1.35200 on the 5:20 candle and also on the 5:25. The top wick of the 5:25 suggested that there was still a relatively decent amount of force being exerted by the buyers in the market although the sellers were keeping it near 1.35200.

I had the least amount of confidence in this set-up relative to the others, but I decided to get into it at the open of the 5:30 candle. This was a 20-minute trade, definitely a bit longer than I would have ideally wanted and a relatively long time to wait. But I felt my odds of winning were still sufficiently high enough to warrant the trade.

Price did hold and the only time the trade went against me was with a bit under ten minutes to go when price dipped below 1.35200 for just a small fraction of a pip. But it stayed above and I won by a good 3+ pips.

I did wait around a bit longer to see if I could get into that put option trade at support 1, but it simply did not present itself. After the market began turning down again back toward support 2 I decided to stop for the day since it looked like I wouldn’t be able to get it. But a 3/3 ITM day is always nice, especially with the way Mondays have been going recently. I can now claim to be 3/8 ITM over the past three Mondays. :)