The Chart Set Up I Use For Futures

This article was originally contributed by the archived community member jxr. We no longer maintain contact details for the original author. The content has been fact-checked and updated for accuracy by our editorial team.

Hello all, I’m going to be blogging about intraday futures trades & traditional option positions.

To start I’ll describe the chart set-up I use for futures & then quickly go over a trade from just after the Chicago open today (7/22).

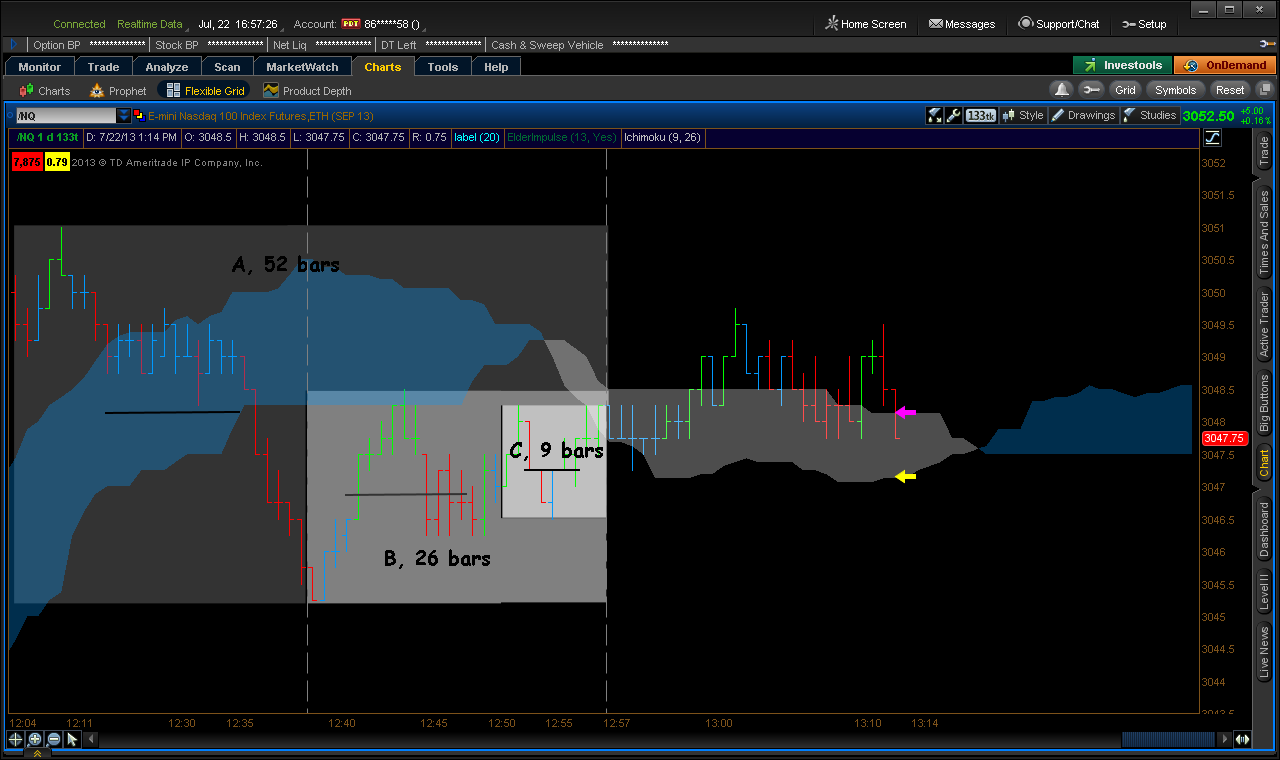

Below is a standard (9,26) Kumo & three nested boxes – A, B&C. The boxes are there to explain what the Kumo is. In each box I’ve marked it’s price midpoint with a black line. The purple arrow points to Span B at the current bar and the yellow one points to Span A. The value of span B at the current bar is equal to the price midpoint of Box A. The value of Span A at the current bar is equal to the average of the midpoints of Boxes B & C.

Each point on the Kumo edge is generated in the same way. The rightmost span A and B are generated from non-shifted boxes A, B&C. It’s all midpoints – that’s important because price tends to move towards midpoints from the edges of ranges in flat markets (think market profile) and away from midpoints in moving markets (think 50% retracement). I think of the Kumo as equilibrium, support/resistance & trend – depending on it’s shape and on price action relative to it.

The box on the left is the first 5 minutes of the Chicago session for the NQ this morning, 7/22. The Kumo is set at (18,52). The faster moving cloud is made of an 8 period EMA and a moving midpoint line just like the Spans that define the Kumo except that it isn’t projected forward and it considers 21 candles. Along the bottom is a DMI, simplified to show only crossovers of the D- and D+.

The important level for this trade is highlighted by the flat bottom of the Kumo on the right hand side. Remember the Kumo extends 52 periods in front of price, the right edge in the picture is actual for the trade entry. The flat bottom is essentially reflecting the 1/2 way point of the move just prior to Chicago open. Notice also that price tested that level during the first 5 minute action.

When price comes back into the Kumo it has some impulse, evidenced by the red candles. It pauses respecting the flat bottom & then breaks through with impulse. At this point I’m looking to get in. The non-impulsive move back to the fast cloud is my entry – at the yellow arrow.

My exit is at the second yellow arrow. The band was getting thin, price had moved a decent amount from the Kumo and it looked as though a double bottom was forming. Simple trade good for 4 points.