The Hard Road – Protect yourself from going bust

10/25/2012

Trading has very much SUCKED for me both weds/thursday. This is where money management/risk management is job #1. This is where you will most likely be tempted to go TILT as a trader. To me its just an efficient marketplace cycling through kind of like a storm passing by. As a trader you can’t allow yourself to be caught in the rain with no protection. I am going to give you some guidelines of how I protect myself when storms come passing by.

1) I limit my number of losing trades in a row to 3. So if I have 3 losses in a row and I feel the market is just not with me I will stop trading for the day.

2) I will reduce % of leverage used on a trade down to 2%. Now for me when things are going well I will trade up to 5% on a trade. When things are not so good I will reduce it down to 2%. This simply reduces your losses under poor trading conditions. Now if you are new and your normal win rate is not as high I would recommend thinking about going even lower to half of what I use for my limits which are between 2-5% some conservative trader do not believe in going over 2% on a trade which is completely up to what you are comfortable with. How greatly your equity curve fluctuates will kind of teach you on what plane to set this on.

3) I will take less trade setups during an online trading day I feel is not in my favor. So I may pass on perfectly good setups at the slightest hint or feeling of a negative result. By doing this you effectively increase your odds by at the very least choosing the best trades or simply this reduces the number of trades in a period of time that is just unfavorable to you in the first place.

All of this being said you can see how when times are rough as they have been for me the past few days that I have effectively contained the damage my account can face. Now the results don’t change you are going to have a tough time and that is just statistics for you in periods like this, but what does change is you have reduced your losses and losing. Now think about the guy that tries to fight these market conditions by doing the inverse of the above – Takes more trades = has more losing trades, because nothing has changed still going to get negative results. or Doubles up on trades if your in a bad trading rut all you are doing is going to double up on your losses or worse get really emotional and bet it all! By setting limits in trades losses % of losses you are focused on defensive measures to reduce the effects of these storms that you will have no control over. You will have your boots, raincoat and umbrella to protect you :)

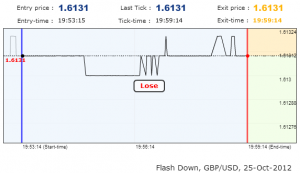

Testing “Betonmarkets” trading platform –

I really like the idea of being able to control up to the exact minute my trades. I think I can increase my profits many fold because of this with these variable expiry times that you can adjust yourself from 30secs to however many minutes you want. Here are to trade examples I had today below. I am starting with $200 in demo money, lets see how I do in the coming weeks. Notice the start and end times of each of the trades 3 and 6 mins that I choose myself with their platform.