To trade or not to trade the Non-farms payroll? (Plus Friday’s trade)

June 7, 2013

One event that many traders look forward to each month is the nonfarm payrolls (NFP). In short, it’s a statistical report over the current state of the labor market in the United States regarding the number of jobs that were added (or lost) over the course of the previous month, excluding farm workers. It’s almost always the single biggest and most anticipated news event on the economic calendar each month with regard to how certain financial markets will react to its release. In the forex market – and, in turn, the binary options market – the release of the data immediately affects the activity of the U.S. dollar. Essentially all pairs involving the USD or otherwise will experience a rapid increase in market action upon the NFP’s release, especially when the report is over or under the expected statistic.

Forex traders care about this because all the extra liquidity brought into the market may help currencies move to a large extent and therefore help bag profits (e.g., shorting the USD if the report is under the expected figure and going long if it exceeds expectations). Many binary traders look forward to the report as essentially a “freebie winner.” For example, if the report exceeds expectations (as it did this month), you might take a call option on any pairs where the USD comes first in the pair (e.g., USD/CHF, USD/JPY, USD/CAD) or take put options on any pairs where the USD is ordered second in the pair (e.g., EUR/USD, GBP/USD, AUD/USD), and vice versa if the report is under the expected amount.

Although this is good in theory, the markets don’t always act in such a clear-cut way. I have traded the release of the NFP in the past on both forex and binary options, but only with mixed success. The issue with trading the NFP on spot forex is that even if you end up being correct on your trade, there’s the possibility that you could get stopped out simply because of how rapidly the market essentially freaks out once it’s released. Then again, you don’t want to place a stop-loss so wide such that the trade involves a significant amount of risk. I swing trade forex on the four-hour and daily charts, so I don’t necessarily close my positions prior to the NFP in order to protect my account. However, if upon its release the data will theoretically go against whatever positions I have open, I will manually close them. I always close all my trades Friday afternoon anyway since you never know what will happen over the weekend and what kind of discrepancy you’ll get between the market close on Friday and open on Sunday (“the gap”).

With binary options, you are simply interested in the direction of where an asset will go so you don’t have to worry about a stop-loss. A stop-loss in binary options is simply built into the amount you invest. But I’ve found that the market doesn’t always act according to how the NFP should dictate how it should act. Each month is different. When there’s a larger discrepancy between the expected and actual figure, going on the side of the market that favors the logical directional expectation of the pair is more likely to result in a winning binary options trade (e.g., for a 15-minute expiry). This past Friday, the NFP was very positive for the U.S. labor market (exceeding expectations) and therefore a put option on the EUR/USD would have worked out very well – or call options on USD-first pairs.

Also, with binary options trading, timing is extremely important. By the time you see or hear the news (I personally use marketwatch.com for up-to-the-minute economic news), pull up your broker’s website, hit the call or put button, type in your trade size, and hit enter, the market could have already moved 10+ pips. There is essentially no delay between the report’s release and the market reaction to it. You will never be able to beat it to the punch, so to speak.

So in my opinion, I think you are better off not trading the actual news release of the NFP. In general, I think it’s important to avoid trading during a time in which an economic report could affect one of the currencies of the pair you’re trading. If the news is significant enough, previous stuff that you’ve been looking at, like candlestick patterns, support and resistance, moving averages – whatever your technical strategy is based off of – will go out the window even if you had a solid set-up. Therefore, before you trade, you should always look at the economic calendar for the day and keep close tabs on the time so you can be mindful of not trading during that window. Sometimes the market may go haywire and cause a losing trade without any pre-announced event taking place, and you cannot fault yourself for that. But not being mindful of potential times when there will be a rapid increase in market liquidity will often damage the quality of your trading. You are much better off trading before the news release or after it, after the market has settled back down into its normal groove.

Anyway, with all of that said, I will discuss my trade from Friday, which occurred before the news release…

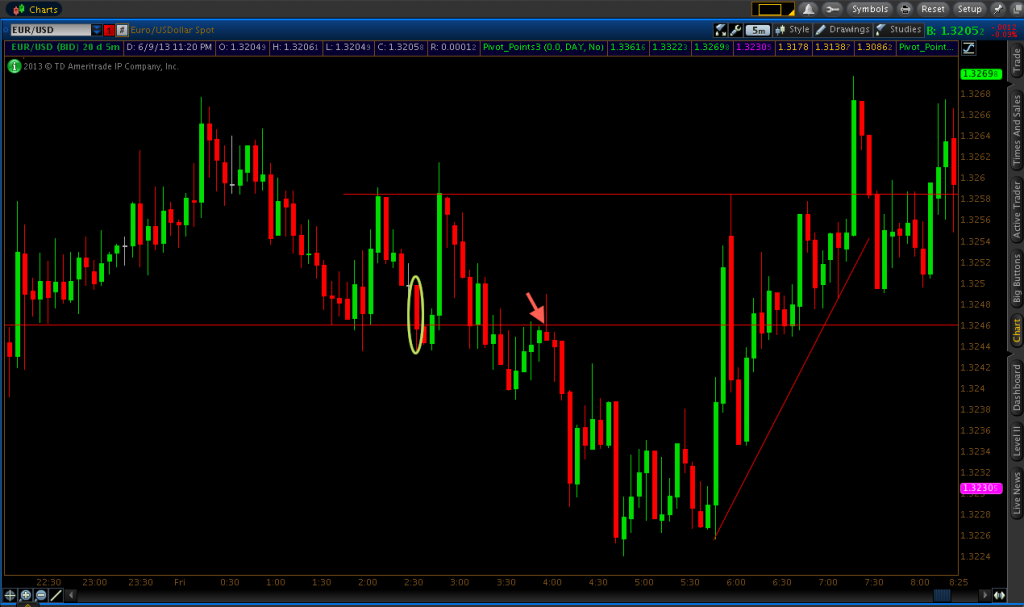

I had 1.32461 marked off on my chart as a potential support or resistance area (bottom red line that extends entirely across the chart in the image below) based on how price had acted earlier that morning, most noticeably between 1:40 and 2:05. I did not take a call option on the 2:35 candle (encapsulated by the green oval) that was hitting down on the 1.32461 level. I was playing my usual waiting game where I wait for a touch of the desired price, rejection and close back above, followed by a touch on the following candle. That never happened, as price fell through 1.32461. It rose thereafter, but as a result of staying patient I avoided a losing trade despite the fact it looked like a solid call option play at the level I had marked off.

The 1.32585 price level (top red line) looked like a solid area for potential put options based on the resistance displayed there earlier in the morning, but momentum was significantly up on the bar that touched the level (16 pips) that I decided to bypass any trades there.

After that, price did fall back down to 1.32461, but I was wary of taking call options there. The support level had been broken just a half-hour before then, which can be a possible indication that the pair wanted to trend lower. It did, and I saved myself another losing trade by not taking that call option set-up.

I finally took my first trade of the day on the 4:00 candle. Since price had gone underneath 1.32461, old support turned into a possible area of new resistance. On the 3:50 candle, price had gone up to that level and rejected it, which validated to me that it was a worthy put option set-up. Price did not come back up to 1.32461 on the subsequent candle, but it did on the one thereafter so I took a put option at the touch of the level and rode it out for a quality seven-pip winner.

That was my first and only trade of the day. I had somewhat considered a put option back up at 1.32585 just after 7AM EST. But price had been trending noticeably upward for the past hour, forming an ascending triangle pattern, which would have made any trade there risky. And, of course, being that I didn’t trade the level just to trade the level, I avoided another losing trade as it blew right through the potentially targeted price. I stopped trading just before the release of the NFP. And in over seven total hours of monitoring the market, I made just one trade in total. Even taking two trades would have been a case of me overtrading on this particular day, which, of course, is something we all want to avoid.