Trading the EUR/USD on August 9, 2013: 2/2 ITM

On Friday, I began trading the EUR/USD around 5AM EST and ended up with two solid trades. The USD/CHF, my usual mainstay, was very choppy and inconducive to trading for me personally (see below screenshot), so I simply decided to switch to the EUR/USD, which seemed a lot friendlier.

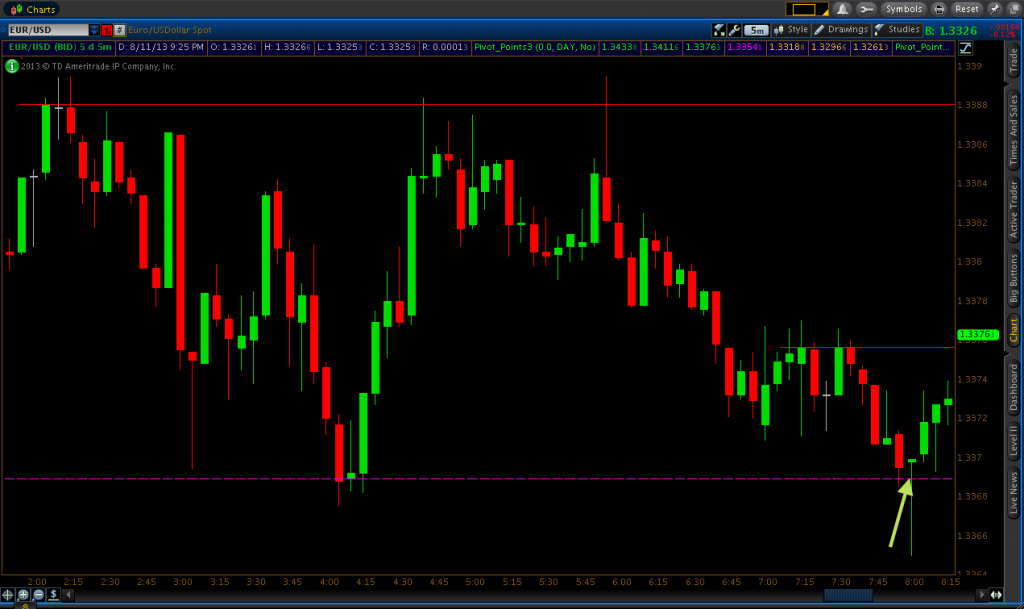

The EUR/USD market appeared very straightforward (screenshots below). Price had sustained two mini-trends during the first part of the morning and was in a twenty-pip range between 1.33689 (the daily pivot denoted by the purple line in the below screenshots) and 1.33881, which was roughly the high for the day that came just after 2AM.

Price did form a support around 1.33803, which I had considered for call options, but I was not able to get a good set-up at the level, as I didn’t get a rejection of 1.33803 when it touched on the 6:00 candlestick. Right before that, the market re-tested the daily high of 1.33881 on the 5:55 jumper candle and came all the way back down. But I did not get a re-touch on any following candles so a put option never materialized.

I ended up taking my first trade of the day, a put option, on the open of the 7:35 candle. This really wasn’t a set-up I could have anticipated just twenty minutes ago, but the market ended up forming an area of resistance at 1.33756. By the time I took that trade, price had tested, rejected, and closed below that level on five different candles within the past half-hour or so. Given that the EUR/USD was also in the context of a downtrend, I decided to take the trade. A resistance level plus a downtrend is usually a solid foundation for a put option. This trade did not move a whole lot in the ten minutes that it was open, but it did go in my direction for pretty much the entire time nonetheless. I wound up with a two-pip winner.

My second trade of the day came down at a revisit of the daily pivot level of 1.33689. Price touched and bounced off the level on the 7:55 candle, helping to validate the pivot level as a support level. Therefore, I took a call option at the touch of 1.33689 on the subsequent candle. At first, the market broke about four pips below my entry point, but fortunately it turned out to be just a false break. This trade ended up as a four-pip winner.

While I did not trade any further after that point, the secondary put option set-up back up on the 1.33756 level looked like a good one worth taking. I would have, however, disqualified further call options at the pivot level from consideration going forward due to the false break that had occurred on the last trade, in addition to the fact that the market was fully in a downtrend at this point.

I hope everyone is doing quite well with their trading or at least on the path to finding their way if just starting out. If you have questions, let me know, and I’d be happy to help. Some of the best advice I can give, in general, as I’ve reitereated a few times here in my blog, is to find a strategy that works and stick with it. Through the series of articles I write, I’m simply giving one rendition of a strategy that works, at least for me personally. Then again, money management and trading psychology are very important components to master, as well, which can only come in time.

One of the simplest, yet most effective, pieces of trading advice that I’ve ever heard is to treat your trading like a business. It’s almost cliché in nature, but it’s something that helped me to become completely impartial by helping to treat trading not as something exciting or something that stirs emotion inside of you, but rather as a series of business transactions or decisions. It’s as if the business is your trading and you are the head of the company executing the decisions. No successful company out there treats its business decisions in an emotional manner, and very often they are planned or considered well in advance, similar to how I treat all of my own trading decisions. If you’re pulling tactics like Martingale-style money management, taking trades that aren’t necessarily there due to either impatience or boredom, and things of that nature, you’re simply putting your trading account at a massive risk. It’s really not any different than putting a monkey at the head of your operation. It’s just not going to work.

Also, on Monday (August 12, 2013) I should have another 60-second options blog post ready, as I know many folks out there have interest in them. In addition, depending on how my time schedule works out in September, I may be including some spot forex material into my blog, as well. I continue my forex trading pretty much year-round at this point, but the binaries are mainly only something I can afford to do when I have the time available to me. But I will see how things go. Thanks for reading!