Trading the USD/CHF on August 6, 2013: 2/4 ITM

I started watching the USD/CHF at around midnight EST. Immediately the first price level that jumped out at me was the 61.8% Fibonacci retracement. This was the major 61.8% Fib (relevant to the price move 0.70675-1.06387) that has been showing up on a regular basis in the USD/CHF. In fact, this was the eighth consecutive day that it had come into play. As a result, price might show diminished sensitivity to the level if it’s no longer a novel occurrence when the reaches that point in the market.

When price did touch the 61.8 level on the 0:15 (12:15AM) candle, it passed through so I bypassed the put option. I always only take trades if they cleanly set up on a level I have targeted ahead of time, so if those don’t materialize I simply move on. It did hang around the 61.8 for close to an hour before heading higher up toward the pivot.

Expectedly, the daily pivot point (0.92906) set up my first trade of the day. Price touched and rejected the pivot on the 1:50 candle. It stuck around the level for around twenty minutes before I finally got a re-touch of 0.92906 on the 2:10 candlestick, where I took a put option. This trade went in my direction initially before going against me and closing three pips out of favor.

Although the market was hanging a bit above the daily pivot, I did not consider 0.92906 for call options. I wanted to see more of a move above it and then a retracement back down to consider call option pivot trades. When it’s going only a few pips above the level, that’s basically telling me that the buyers simply haven’t completely overwhelmed the selling to the point where call options are realistic, high-probability set-ups. Moreover, it goes back to the whole concept of not taking a call option when there’s resistance just a few pips above (and vice versa).

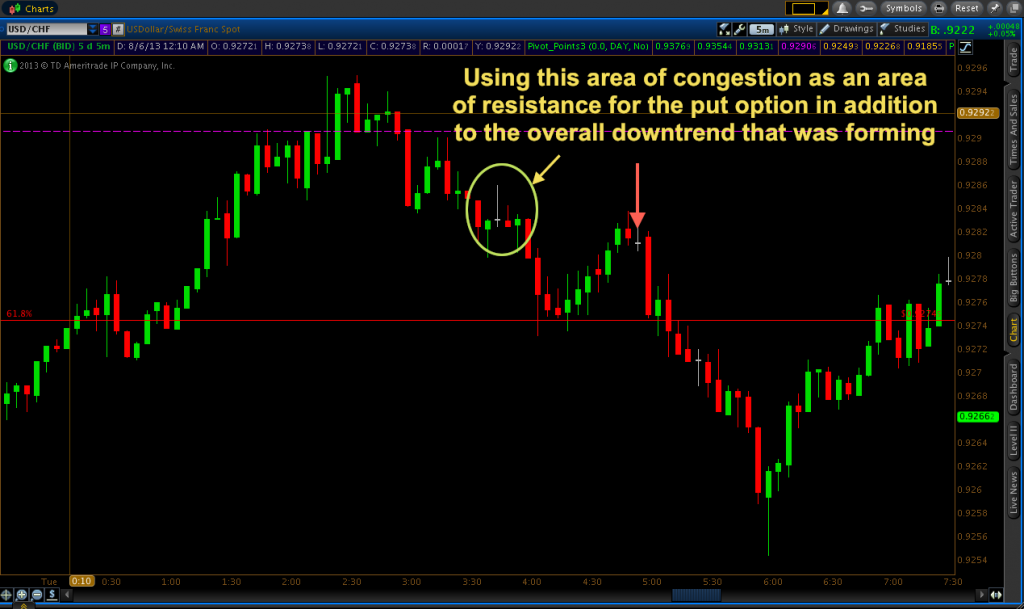

The market did fall back below the pivot point and suggested that the pair had no real impetus to establish a trend this early. The market did see some congestion around 0.92824, roughly halfway between the pivot and 61.8% Fibonacci retracement back down at 0.92745, but it was nothing worth immediately trading.

My next trade actually set up on the 61.8% Fib. Price came down and touched on the 4:05 candlestick before rejecting and wicking back up. Although nothing had set up on the level earlier in the morning, price did show some up-and-down consolidation around the level, making it a decent area to expect some type of reversal. Two more bearish candles followed the 4:05 before retouching 0.92745 on the 4:20 candle. At that point, I took a call option and saw this trade close out as a four-pip winner.

As price was heading back up, there was once again some consolidation seen around the 0.92824 area that I mentioned earlier. Both the 4:45 and 4:50 candle wicked at the area, and the market was currently downtrending over the past couple hours, so on the touch of 0.92824 on the 4:55 candle I took a put option, expecting the resistance level to hold. It did hold and produced a much bigger winner than I expected, covering nine pips.

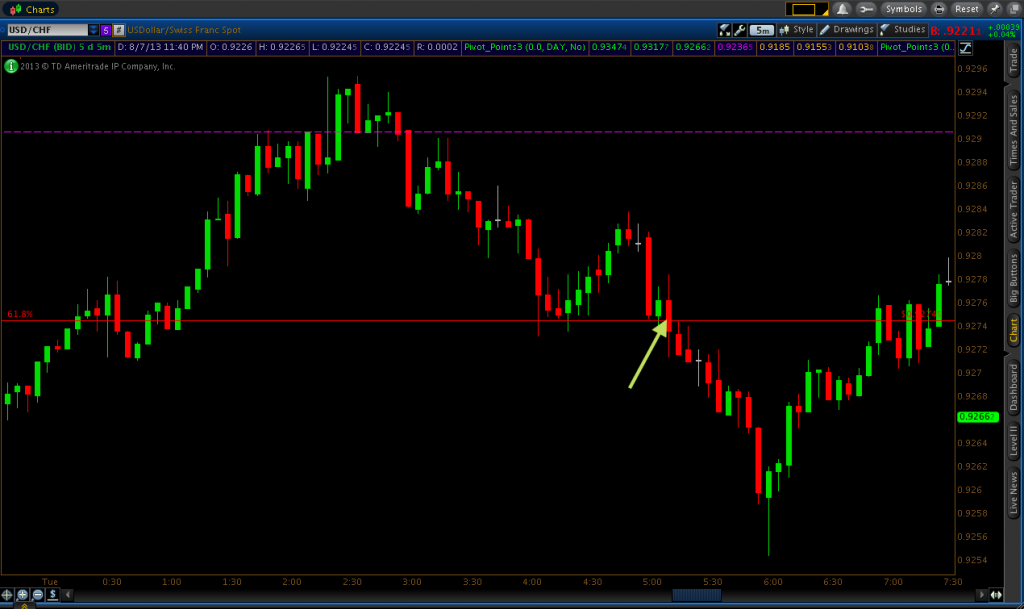

Meanwhile, as that trade was still in motion, another call option opportunity was setting up again at the 61.8% Fibonacci retracement of 0.92745. The market re-touched the 61.8% Fib on the 5:05 candlestick before wicking back up and forming a bullish candle. This was a bit of a riskier trade set-up given that the trend had been down overall and seemed likely to head down lower overall given that price had only retraced back up to roughly halfway between the pivot and 61.8% Fib. But then again, I had that price action signal and a major Fibonacci retracement level working in my favor so I decided to give the call option a try on the 5:10 candle upon the re-touch of 0.92745. Alas, this trade went against me almost immediately and never really showed much evidence of having enough energy to come back and finish in-the-money.

I continued to follow the USD/CHF for another two hours afterward. I had no real ideas in mind for call option opportunities. The market was so strongly in a morning downtrend by this point that call options would have been like trying to catch a falling knife anyway. But on the retrace back up, I was ideally looking for a put option on the 61.8% Fib level. That would have been a great put option set-up in the context of a downtrend, but price passed through and closed above it on the first touch. The market did meander around the 61.8 Fib again for about a half-hour, but nothing cleanly on the level so I decided to call it quits for the day. I went an unprofitable 2/4 ITM, but I’ve been having some pretty good days lately so a poorer ITM% day is bound to happen from time to time even though today was still a good market to work with.