USD/CHF and EUR/USD Trading on August 7, 2013: 3/5 ITM (1 ATM)

I began watching the USD/CHF a little before 12AM EST. I gave it only marginal attention for the first couple hours as very little volume was in the market and I was basically just waiting for it to make a move. In terms of price levels, I had the daily pivot level of 0.92633 available, as well as the 61.8% Fibonacci retracement (0.92745), which would end up coming into play for the ninth consecutive trading day.

Some minor support was available at 0.92536 that formed just before 1AM, but I prefer to ignore weaker support and resistance levels when entering higher-volatility time periods (e.g., European morning), as they tend to not hold as well as they might in lower-volatility periods (e.g., Asian session). The USD/CHF finally started to move a bit more around 2AM and eventually made its way up to the pivot (purple line in below screenshots) by 3AM. Nevertheless, I wasn’t able to use the pivot as a put option set-up, as the level did not hold as resistance on its first touch and instead breached and closed above 0.92633.

Afterward, the market made its way up to the 61.8% Fibonacci retracement level. But again, similar to what happened at the daily pivot, price went through the 61.8 Fib and closed above it. However, price did hang around the level for about 25 minutes, showing that the 0.92745 was plenty sensitive as a market price for potential call option set-ups on a retracement back down.

The next level I had targeted was the resistance 1 level at 0.92889. However, price began retracing back down about five pips shy of resistance 1. The market touched and rejected the 61.8% Fib on the 4:50 candle, leading to (finally) my first trade set-up of the day on the subsequent re-touch of 0.92745 on the 4:55 candle. This call option did very well going with the morning uptrend and closed out seven pips in favor.

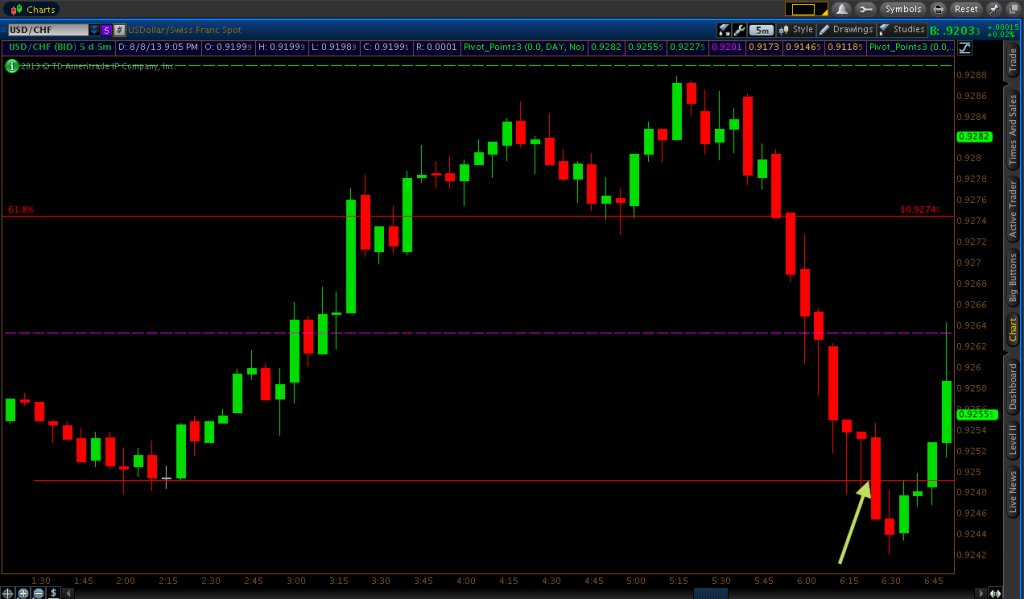

After that, the market came very close to resistance 1 (1-2 pips) before again retracing back down. And for some reason, beginning just before 6AM, the USD started aggressively selling off. I checked to see if this was occurring on other USD pairs, and it was. The EUR/USD saw a rise in price (Euro gaining against the USD), and in the process, I actually found a trade set-ups on both pairs at the same time.

On the USD/CHF, strong wicks formed on two consecutive candles along the 0.92492 support level. At first I was cautious of taking any call options given the strong sell-off that was occurring. But two strong consecutive wicks at a support level usually represents a good trade set-up and I felt a reversal could be in store.

Moreover, cross-checking this price movement against the EUR/USD, a trade reversal also seemed likely on that pair given that it was pushing up against a major 23.6% Fibonacci level (1.33164) drawn from nearly a 1,700-pip range of price data (1.20411-1.37104). Price rejected the 23.6% Fib on the 6:15 candle before I got in a put option at the touch of the Fibonacci line on the 6:20 candle. This trade finished directly at-the-money.

Back on the USD/CHF, I took a call option at 0.92492 on the 6:25 candle, planned for a 6:45 expiry. This trade did go against me right away, and although it showed signs of a potential comeback toward the latter stages, it closed out as a one-pip loss. The expectation of a price reversal on both pairs was correct, however, but I simply wasn’t able to get any winning trades out of it.

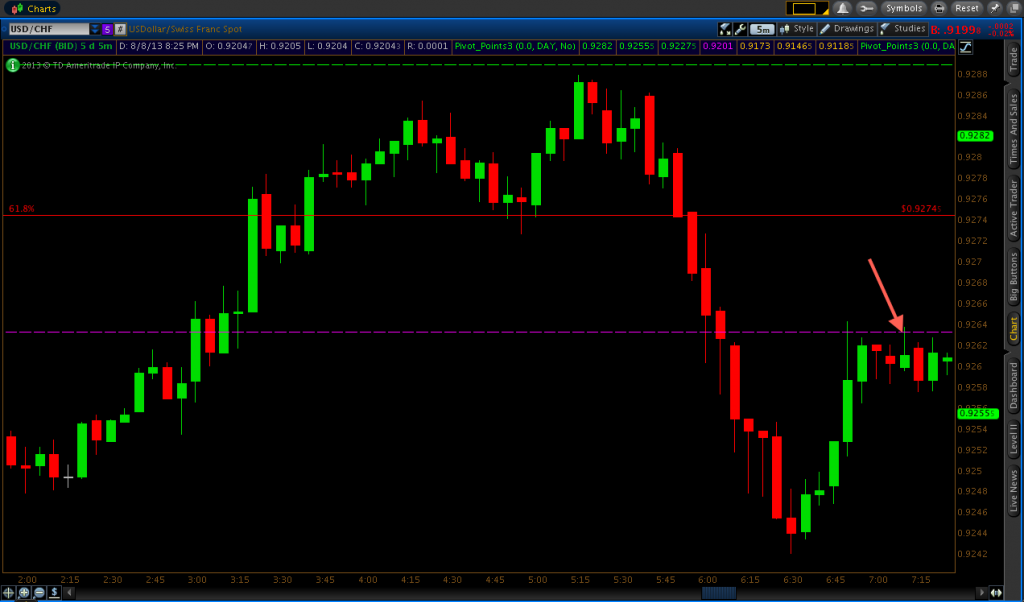

My next trade was also on the EUR/USD. After encountering resistance from the 23.6% Fibonacci level, price retraced back down to the daily pivot point of 1.32904 and bounced off. Given this candlestick (the 6:50) had a comparatively large amount of price movement, I decided to wait on more confirmation to determine whether the pivot level would be acting as a valid level of support. Given that it rejected the pivot again on the 6:55 candle, I took a call option at the touch of 1.32904 on the 7:00 candle. This trade wound up a four-pip winner.

My final trade of the day came back on the USD/CHF. Price came up and rejected the pivot level on the 6:50 candle. Of course, the same exact thing happened on the EUR/USD, which shouldn’t seem surprising as nearly all forex pairs show levels of correlation to varying degrees. This is especially true for all USD pairs, being that the USD is far and away the most traded currency out there as it essentially acts as the world’s reserve currency. As such, the value of the USD is easily the primary mover in each pair it’s involved in.

After the rejection of the pivot point on the 6:50 candle, price stayed around the level before re-touching on the 7:10 candle, where I took a put option at 0.92633. This trade stayed in my favor pretty much the entire time and it produced a 2-3 pip winner.

Using currency pair correlation can be a valuable tool when trading any foreign exchange instruments, including spot forex, binary options, or vanilla options. It can lend valuable information on what currency pair is leading the movement, and give a clearer idea of how trades set-ups might play out. For instance, if you’re taking a call option on a USD/CHF trade, yet the USD/JPY is near a resistance level (or the EUR/USD is close to a support level, for example) on the same timeframe, that might inform you that the trade has a lower probability of actually working out. Nevertheless, I don’t “cross-check” that often. Back when I traded four or more pairs at the same time with all charts on the screen at once, studying the correlation did come in handy on occasion. Now, I usually prefer just to trade what is in front of me on the lone chart that I’m paying my undivided attention to. But cross-checking a currency pair you’re trading against other related pairs can be a useful tool.