Why You Want To Trade 0-100 Binary Options

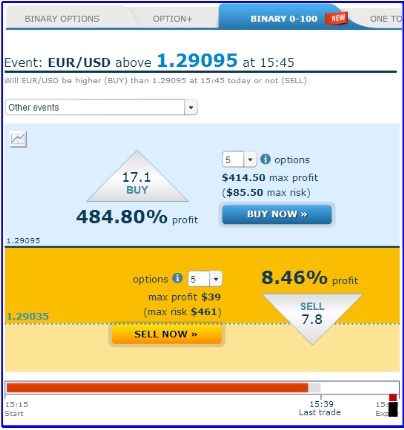

There is a new kid on the block and it’s known as 0-100 binary options. Well, maybe they aren’t so new but there have been some developments over the past year that have brought them into the spotlight. If you don’t know what this type of trading is here is a little primer. Like standard spot binary positions, a 0-100 option only has two possible values at expiration; all or nothing. Unlike spot binary these options are worth either $0 or $100, not your initial investment plus 80%. Because of the nature of the contract they are traded in lots and strike prices are preset. The value of each contract will vary with the price of the underlying asset in a range between $0 and $100. Your profit, assuming the option closes in the money, is the difference between the purchase price and $100.

This may sound complicated at first but there are numerous advantages to trading this way. For one, leverage. There is a much larger potential for profit than trading standard spot binary. Another is tradability. Unless your broker has some form of early out option variety you can’t get out of a spot position until expiration. With 0-100 you can trade them any time. Yet another is regulation. You may have figured out by now that this is the same type of binary option allowed by the U.S. CFTC, it is also now being used as the standard for trading binary options in Japan as well as by at least one innovative European based broker. Perhaps the biggest advantage I have found to trading 0-100 is credit positions. These options are bought or sold to open, unlike other options where you either buy a call or buy a put.

Four Reasons Why You Want To Trade 0-100 Binary Options

Leverage is the key to trading options. It is the benefit you receive for taking the risk of trading a speculative position. Spot binary offers good leverage, up to 80 or 90% for the standard high/low position and up to 300% or more for one touch and range options. Because of the nature of the 0-100 option it is possible to get leverage in excess of 1000%. This is how it works; the option is priced between $0 and $100 based on the price of the underlying asset. By choosing an option that is out of the money it is possible to get in for as little as $5 or less. If the asset performs as expected and closes in the money you receive $100 in return. Your profit is the $100 minus the $5 you paid to get in which is $95 or 1900%. Now, this kind of return is not the norm but it is easy to see how leverage is increased. If you buy an option for $45 your potential profits are $55 or 122%, much more than the 70% I receive regularly for a spot position.

Trad-ability is another major advantage to this type of trading. Some spot brokers have an early out feature but not all. From what I have seen if there is one it is usually very limited and comes with a trading window. You usually have to wait for the window to open (after you have bought your position) and then you have to close the position before the window closes (usually 5-15 minutes before expiry). With 0-100 options you can trade them anytime the market is open for trading. This means you can take profits when you want to or cut losses when you need.

One of the limitations of trading spot binary is that there are no credit positions. If you are bullish you buy a call and if you are bearish you buy a put, always giving money to the broker. There is no effective way to truly hedge a spot binary position. Things are different for 0-100 trading. With this type you still have to buy a position to open, but if you are bearish you sell it to open. This results in a credit to your account. If the option closes in the money then you keep the credit, if it closes out of the money you lose the credit and the difference between it and $100. For example; you sell an option for $35 and the asset closes in the money so you keep the $35. If however it closes out of the money you owe $100 to the counter party. This means you lose the difference between the credit and $100 or in this case $65.

Regulation is a big concern for the binary options industry. Binary trading is global but binary options regulation is local and regional. Japan FSA’s choice to use the 0-100 binary option, along with the CFTC, reinforces my opinion that it could become the international standard. This would mean that brokers could operate across borders and traders, like myself based in the U.S., would be able to use any broker we wished without fear.

AnyOptions 0-100 options AKA speed trading

At this time there are only a few brokers offering this kind of trading. In Japan it is the only kind of binary options allowed by the regulation put into place summer 2013. Platform provider Tradelogic is a leader in this field with their new option product, Binary 100. In the U.S. there is Nadex and a new exchange called Cantor Markets. In Europe CySEC regulated AnyOption is leading the way in this arena. AnyOption launched what they call 0-100 Binary sometime in early 2013. I am sure by now it is easy to see the potential in 0-100 binary options.