Why You Want To Trade A Lot

This may seem counter to what many resources for traders will tell you but you really do want to trade… a lot. I know that the voice of experience will tell the new trader that you don’t have to trade all the time, you don’t need to make lots of trades and you certainly don’t need to force trades when they are not there. There are certainly many bad aspects of trading a lot but there is also a few reason why you should. It comes down to numbers and since we’re all here about the numbers I know you will want to read this. What do the numbers tell us? I can’t be sure what they tell you but I do know what they tell me, the more I trade the more likely I am to hit or beat my average win/loss percentage. One thing to remember; trading a lot does not mean the same thing as trading too much.

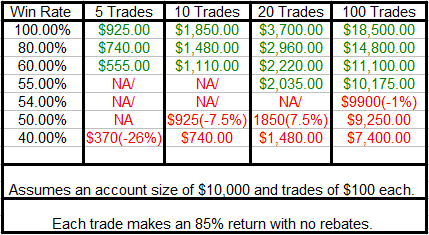

It is generally recognized that you have to have a winning trade percentage of at least 54% to maintain break even in your account. This is because of how the payout system in binary options works and can vary from broker to broker depending on how much they return and any rebates or trade insurance available. Because when you lose a trade you lose more money than you win if the trade profits you must win more times than you lose just to maintain break even. In order to profit you have to have a percentage greater than 54%. This is a tough number for some to reach and keep up and the reason may be that they are not trading enough.

This is what I mean. Let’s assume you are using a broker that pays 85% for a winner and 0% for a loser. You make one trade for $100 and lose the $100. Then you make another trade for $100 and win back $185. Your win/loss percentage is 50% and you have made back $85 of the $100 you lost but are still net negative. Now you make another trade for $100 and profit another $185. At that point your win percentage is 66.6% (2 out of 3) and you are net profitable by $70. Keep in mind that in this scenario each trade is 33% of trade volume and only one trade can tip the balance between profits and losses. Adding one more trade to the equation changes the numbers drastically. Another win makes the win rate 75%; another loss makes takes it back to 50% and a net loss.

It’s All About The Numbers

Now that I have established that you need to win more than you lose in order to be profitable lets move on to why you want to trade a lot. Again it comes down to numbers. Let’s assume that you make 5 trades per week, one per day. This may seem like a disciplined approach, and it is, but it may also be hampering your ability to profit. If you trade only 5 times then each trade has a bigger affect on your account. Assuming you make 5 trades and one is a loser then you are 80% profitable. If you lose two then you are 60% profitable and if you lose three then you are only 40% profitable and now a net loser on the week. Each trade affected you percentage by a fifth. In order to remain profitable on a week to week basis you must win 3 out of 5 trades every week for a 60% profitability ratio. Now, let’s assume you make 10 trades per week and everything else remains the same. Since we are making ten trades each trade will only affect profitability by 10%. If one is a loser you’re at 90%, if two lose then 80% and so on down the line until you lose 5 trades. Once you lose five trades you are a net loser on the week with 50% profitability.

I think by now it is easy to see why you want to trade a lot. The more you trade the less impact each trade will have on your account. No one trade will be able to put you into a position where you fall below the profitability line. However, you can’t just trade a lot. There is still risk with this approach, you have to have a sound strategy and you must apply money management to your account in order to protect your balance. You can’t trade wildly, each must be based on sound trading strategy. Also, if you are making investments that are too big to be sustainable only one or two losses could wash you out of the market and make it impossible to do any trading. This is why I like to keep all my trades very small. I started out trading only 1% of my account at a time. For an account with a balance of $10,000 this means only trading $100 at a time. It also means that you could conceivably have as many as 100 open trades at a time, more than enough for even the most prolific traders. If you look at the table you can see that not only does making more trades lower the required win rate to break even, it also reduces the risk of losses if you go below break even.